CBO: Other Peoples’ Money is Popular, as is Freedom to Choose

The big news on Thursday was that the Congressional Budget Office (CBO) released its score of the American Health Care Act (AHCA). The CBO claimed 23 million people would lose coverage within a decade under provisions found in the AHCA.

The big news on Thursday was that the Congressional Budget Office (CBO) released its score of the American Health Care Act (AHCA). The CBO claimed 23 million people would lose coverage within a decade under provisions found in the AHCA.

- About 10 million people would purportedly lose coverage due to the repealing of the individual and employer mandates.

- Another 5 million are low-income individuals living in states that did not expand Medicaid.

Basically, this is another way of saying 10 million people will decide they’d rather keep their money than have poor-value health coverage. It’s hard to understand how someone can lose something they never actually had?

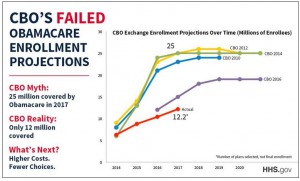

Another issue is whether the CBO’s estimates even matter. Its track record projecting Obamacare enrollees was way under what it estimated year-after-year. [See the Figure]

According to the New York Times, the winners would be people who are young, healthy and higher income. By winner, the Times means those who are allowed to keep more of their hard-earned money rather than being forced to throw it down the Obamacare rat hole. The losers would be the people who will not benefit from the aforementioned coerced charity.

Health policy analyst Chris Jacobs explains that the AHCA would reduce deficits by $119 billion over a decade. That’s good for taxpayers.

Health Insurance premiums would also fall, on average, but the exact amount would vary depending on the state in which applicants reside. States would be allowed to apply for waivers from various insurance regulations, including essential health benefits and community rating.

According to Jacobs:

- The CBO assumes about half of states will not apply for waiver – maintaining all remaining Obamacare regulations;

- One-third of states will opt for moderate waivers;

- The remainder of states are expected to apply for more aggressive with waivers.

States opting for no waivers will see very little change in premiums.

- In states that apply for no waivers, premiums will fall by perhaps 4%.

- States who adopt a moderate approach to waivers can expect to reduce premiums by 10% to 30%, or about 20% on average.

- In states that adopting a more aggressive approaches to waivers, healthy individuals will be able to reduce premiums significantly. By contrast, unhealthy individuals may find their costs higher or potentially not be able to buy coverage at all.

The CBO worries that some individuals might opt for limited benefits plans that will not cover all their medical risks. I’m not convinced that’s is bad. Most people do not need comprehensive coverage. Draining the swamp of all the excess cross-subsidies will force providers to compete and be more transparent on pricing.

Devon, you are correct that the CBO is always wrong. This report is like the government spreading propaganda that just won’t work.

States like Florida need the opportunity to seek aggressive waivers to reduce the cost of health insurance. Medical underwriting will make the premiums plummet. A 30-year-old couple and 2 children will be able to purchase HSA Qualifying insurance for about $6,000 in Florida with a $6,550 deductible. The unused amount of the credit, $3000, should be deposited into the family’s HSA. If the wife has had cancer and is un-insurable then she would pay double or $4,000, to the High Risk Pool (HRP) and then the unused amount of the credit is $1,000.

In States like Utah the age-based tax credit is the same, $9,000 for this family, but the premiums are about 20% less so the HSA deposits increase to $4,200 from President Trump. If the wife has to go to the HRP then the family’s premiums are 100% paid, including her HRP, but the HSA deposit is smaller at $2,600. Even with a parent on the High Risk Pool the premiums are paid 100% with a HSA deposit from President Trump.

There are billions and billions of Federal dollars for these High Risk Pools (HRP). But the States administer these programs and can add additional money from savings on not having to pay for 200,000 State employees’ health insurance like here in Florida. Big savings will also come from Medicaid because the broke consumers would prefer the age-based tax credits and HSA deposits, which is much cheaper than Medicaid.

Florida could add a 1% premium tax to all health insurance premiums to help pay for the HRP to maintain the premiums at 100% more than medically underwritten premiums. Personally, I say let Floridians keep their money and the next Florida Governor, Adam Putnam, should make Northern vacationers pay for the HRP with a hotel tax. We get millions and millions of theses people every year. People save all year long to come to Florida and they won’t even notice that hotel tax.

Florida local taxes should drop like a rock because cities, counties and school districts no longer have to pay for over-priced employer-based insurance. When we lift the cost of health insurance off the backs of Florida employers the Florida economy will explode. Like I have always said, these tax-free HSAs are a panacea!

Free money usually is.

I really like your idea of a premium tax in order to help finance the high risk pool.

Going back to medical underwriting will of course lower the premiums of healthy persons by 50 percent, which is great.

However, if the premiums for unhealthy persons were to soar out of sight, this will be all over the media and (right or wrong) will discredit the underwriting benefits.

I see nothing wrong with having all insureds contribute something toward the high risk pool.

Bob, if you believe carrying insurance is socially responsible, why would you want to raise their premiums? By doing so you are encouraging them to forgo buying insurance.

There are better ways to collect a tax. I see no reason why this shouldn’t come out of the general fund.

Jimbino would probably like the idea though.

Financing for the pre-ACA high risk pools, if you average them all together, came one-third from beneficiary premiums, one-third from general state revenues, and one-third from a surcharge on insurance premiums. They never covered more than 200,000 people altogether even though experts estimated that at least 4-5 million people needed them.

If high risk pools today were to have a benefits package equivalent to an ACA Bronze or Silver plan and depending on how many people had to use them because they couldn’t pass underwriting, the percentage surcharge on underwritten insurance plans could be quite high if that were the only source of financing beyond beneficiary premiums. If premiums were capped at 10% of pretax income and less than that for those with income below 300% of the FPL, federal or state subsidies would also be required to make the model work.

The state high risk pools before the ACA had an average loss of $12,000 per year per person.

The high risk pool set up for 3 years by the ACA had an average loss of $32,000 a year per person.

The state pools had higher premiums, and excluded pre-ex conditions for 6 to 12 months, and had annual and lifetime maximums.

The ACA risk pools at first accepted any charges by hospitals. Later they went to a Medicaid type fee schedule and cut their losses.

Anyways, we have to make some assumptions about how many high risk persons there are in the individual market.

If that number is 2 million, and we can hold the average loss to $20,000, then a national high risk pool needs $40 billion a year in federal and state money.

This does need a national tax of some kind.

One note,however. There are some states like NY and Calif which will likely keep community rating forever and never utiiize a high risk pool. This will lower the dollars needed for high risk pools.

I’m 72 and type II diabetic. Otherwise I’m in good health, and I have the good sense to seek medical care in places like Brazil or Mexico, where it is much cheaper. A colonoscopy in Brazil, for example, is advertised for $500, for example, a fraction of what USSA facilities charge, and I had cataract surgery in Rio for a fraction of what it would cost in the USSA.

Being fluent in Portuguese and Spanish and familiar with almost all the latin countries of the Americas enables me to escape the stupid Amerikan “insurance is necessary” mentality and I’ll be damned if I ever participate in Socialized Medicine in Amerika. Insurance is for wimps.

Jimbino, pretend you are a woman and have breast cancer, would you rather have the outcomes (survival rate) of the US at number 1 or the outcomes of Brazil at number 28 out of 30? Or, put another way, would you rather have the US 5 year survival rate of ~83% or the Brazilian 5 year survival rate of less than 60%?[CONCORD study of cancer survival]

That was unfair because you are not a woman. If you should develop cancer of the colon would you prefer the outcomes of the US at number 2 or the outcomes of Brazil at number 28 out of 30? [Brazil does better with cancer of the rectum at number 12 out of 30 (the US is consistently number one or two)] Or, put another way, would you prefer Brazil’s 5 year survival rate of less than 40% or the US 5 year survival rate of greater than 60%?

I wonder if the survival rates in Brazil is for the public or private sector hospital / clinics. I can easily see how rationing by waiting in the public sector could reduce outcomes. For that matter, I can see how someone waiting for care in the public sector who finally tries to pay cash in the private sector might be a more advanced case than someone who first sought care in the private sector.

Devon, it is very difficult to compare internationally. Not only that but there is a lot of difficulty in obtaining accurate data. The US is pretty good at reporting the negatives.