America Just Got Poorer

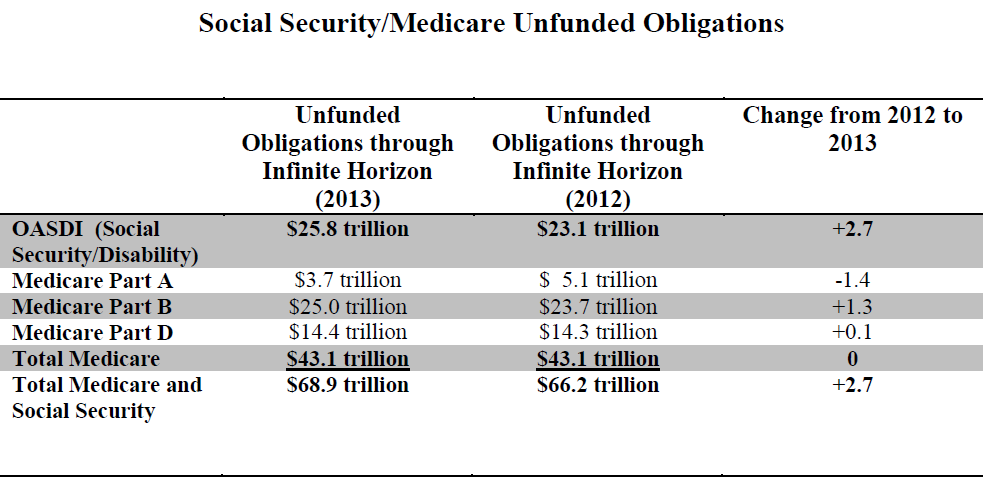

Today’s Social Security and Medicare Trustees Reports announce that the hospital insurance portion of Medicare’s unfunded liability is down from last year. But many news reports are overlooking the bad news: Medicare’s total long term deficit, which is essentially unchanged, is offset by an increase in the unfunded liability in other entitlements, especially the Disability program. The total unfunded liability for both programs this year is nearly $69 trillion, more than the $66.2 trillion reported last year, according to the Trustees.

Saltwater economists will tell you that these sort of projections are ultimately worthless. No private firm would ever attempt to create models which calculate costs over an infinite horizon. These are just safety blankets/scare tactics for political purposes.

They still serve an important purpose though. Of course they don’t foretell the future, but at least they can let legislators know if they’re on the right path.

“No private firm would ever attempt to create models which calculate costs over an infinite horizon.”

Maybe so.

Regardless, you need to look at the actual report.

You will find the report projects Medicare’s unfunded liabilities over a 75-year period.

You will also find the report acknowledges that experts challenged the result of the 75-year projection on grounds that it understates the full impact of people continually “aging into” benefits eligibility.

You will then note that the report also specifies how much the calculation assuming an infinite horizon adds to the total calculation of unfunded liability above 75 years. (Less than half.)

So if you prefer, just ignore the infinite horizon calculation.

The 75-year horizon is chilling enough all by itself.

Day after day, the US just continues to spiral into unstable economic waters.

It’s a shame that we feel the need to spend even more money from year to year.

Also, am I the only one that feels there is a huge problem when the president cannot get even 10 votes in either house on his budget proposals?

You are completely right, Steve. It is a huge problem, but it is entirely created by Obama’s proposals increase spending exorbitantly.

Thats a pretty scary amount. Eventually we won’t be able to pay the benefits.

We would still be stuck with all of the debt. Scary indeed

Wouldn’t it be better to use the 75 year horizon? That seems more realistic than the infinite.

Why? Will everybody just up and die in 75 years and no more benefits will need to be paid?

Excellent presentation of the information. What the president needs to do is create a commission (like Reagan did) to establish a plan to either slowing close the SS program, or find a way to increase taxes and decrease benefit to keep it alive another 50-75 years.

Why doesn’t the federal government just increase borrowing to temporarily keep it open, according to Paul Krugman increase debt isn’t really such a bad thing.

Because increased debt is a bad thing when the U.S. cannot pay the interest on the debt and it decreases our credit rating in the long run.

It’s even worse than that. Increased debt means increased debt service. Debt service is spending, too. CBO fiscal scenario analysis in 2012 showed debt service is now the largest source of growth in federal spending.

So the worse problem is debt service. Specifically spending to service the debt is “crowding out” spending for other things that actually, you know, help people or keep the government running. Or even allow the Army to continue serving hot meals to our soldiers in Afghanistan.

Has the administration been thinking about whether – and how – to default on meaningful portions of the debt?

Or thinking about how much taxes must rise in order to start bringing down the debt?

(Recall that this administration promised that ObamaCare would “not add one dime” to the debt while at the same time would extend medical insurance to the 45 million Americans who are presently uninsured. Who still believes that today?)

These estimates are pure fiction. They are based on current law which assumes Medicare physician fees will be cut by 25%. Congress knows this will cause many doctors to stop treating Medicare patients. Also, the projections assume the trust funds actually have funds. The trust fund is an accounting notion that merely tracks how much money future taxpayers owe to future retirees. There are no physical assets.

So Buster, are you saying that Medicare’s financial picture is even worse than the Trustees report says?

If that’s what you’re saying – I agree with you.

I haven’t looked at this years reports yet, but it is doubtful they have changed methods that have been broken in the last several years of reports I have looked at. The Medicare forecasts use some of the same core future projections that the Social Security projections use for various factors that determine revenue like future labor force participation rates and GDP and interest rates. This page indicates many obviously questionable methods they use that could lead them be off by a wide margin… even without getting into the assumptions regarding healthcare prices:

http://www.politicsdebunked.com/article-list/ssaestimates

Unfortunately I don’t have high profile connections to spread the word about their flaws. I’m a tech entrepreneur who looked at government forecasts as if they were business plans.. and found them very poorly done, not even “close enough for government work”.

The table of liabilities makes it seem like Medicare’s benefit structure is embedded in the Constitution, or in the Ten Commandments, or in nature itself.

Medicare Parts B and D show the largest liabilities — but their benefit structure could be changed overnite.

Part B could have a $5000 deductible.

Part D could pay for generic drugs only.

These changes or similar ones could lower the

‘liability’ immediately.

This is a somewhat stretched analogy, but if you looked at the US Defense budget in the summer of 1945 you could have said that we had a zillion-dollar future liability.

Of course the liability virtually disappeared.