2015 Medicare Trustees Report: No Pot O’ Gold in Medicare’s Future

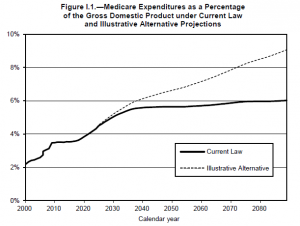

The Trustees for Social Security and Medicare released their 2015 Trustees’ Report. Liberal stalwart, Mother Jones, proclaimed how wonderful it was. Political blogger Kevin Drum had an interesting argument showing how long-term medical cost projections were down from a decade ago. However, he also conceded that others think the current slowdown is temporary. Yet, if you look at the report itself the news isn’t very reassuring. In 2000, Medicare spending as a percentage of GDP was just above 2 percent. It’s now about 3.5 percent and will be four percent by 2023.

The percent of GDP spent on Medicare is not projected to exceed 6 percent through 2089 (that supposedly the good news). That is, assuming conditions under “Current Law” actually take place. The Illustrative Alternative report (the report where the actuary says what he believes will actually happen) estimates Medicare spending could be 9 percent of GDP in 2089. That’s about 50 percent higher than under current law projections. Basically, Medicare spending will slow down if Congress does what it’s failed to do for the past 20 years. That sounds like a big “if”. For instance, current law assumes the Independent Payment Advisory Board will remain in place, the reductions to physician fees will remain, as will other Medicare fee reductions.

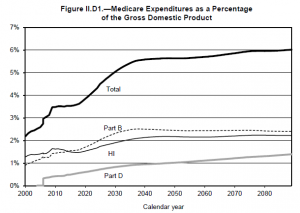

There is other bad news. In 2014 spending on Medicare drugs was .5 percent of GDP. This proportion will triple over the next 75 years as specialty drugs displace spending on cheap generics [see Part D in Figure II.D1.]. The reality is drug spending could be much higher than estimated. Only a decade ago, there were very few so-called specialty drugs. A couple years ago, one percent of drugs (i.e. specialty drugs) accounted for one-quarter of drug spending. Last year this increased to nearly one-third. By the end of the decade half of drug spending will be on specialty drugs.

Specialty drugs are those drugs that cost from $1,500 to $30,000 per month. Sometimes they cost even more. A course of treatment with some oncology drugs is in the hundreds of thousands of dollars. Specialty drug is not an official classification of the U.S. Food and Drug Administration. Rather, it is used to describe the new generation of high cost treatments and biological agents.

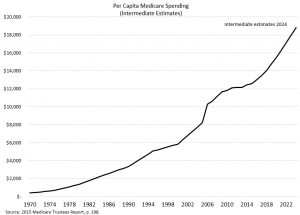

When the Medicare program was created, nobody expected spending to grow by much. Seniors didn’t qualify for Medicare until age 65, many didn’t make it that far. Heart disease was the primary killer of Americans who reached middle age. A doctor once told me cardiology was a dismal profession about the time Medicare began because every patient a cardiologist met would likely die with months. In 1970, annual per capita Medicare spending was only $385. Today it’s above $12,000; and it is projected to surpass $18,000 a decade from now. The point is, medical science will continually advance and create new treatments at ever-increasing prices.

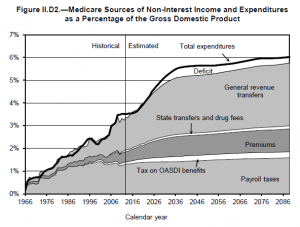

In 1970, payroll taxes and premiums paid virtually all Medicare’s program costs. Only a few decades from now, general revenues will be needed to cover about half of program costs. That’s assuming program costs are constrained to only 6 percent of GPD. That’s scary enough; taxpayers will be on the hook for Medicare spending equal to three percent of GDP. Today, total Medicare spending is about 3.5 percent of GPD, while payroll taxes and premiums cover about 57 percent of that. In the coming years, taxpayers’ burden for Medicare spending will rise from about 1.5 percent of GDP to three percent of GDP. Of course, that assumes the provisions under current law actually take place. Under the Illustrative Alternative, Medicare spending could reach nine percent of GDP. Under that (more likely scenario), taxpayers could find their burden quadrupling from its current level of 1.5 percent of GDP to 6 percent of GDP. That is nothing to celebrate.

One parting thought. The Trust Fund itself is little more than a filing cabinet full of IOUs that are claims on future taxpayers. There really is no Trust Fund in the traditional sense. My colleague, Pam Villarreal, blogged about the Social Security Trust Report here.

You are correct about the trust fund

Current contributions cover more than half of the costs assuming the contributions were used to pay Medicare costs

The contributions were loaned to the Treasury’s general fund to pay general expenses

Treasuries were issued as collateral for the loans

They are an asset to the trust fund and a liability to the Treasury

The net effect is there is a wash, with zero value

Thus the trust fund has zero dollars

Don Levit

Bad news: the train we’re on is speeding headlong toward a collapsed bridge over a deep canyon.

Good news: the engineer reports our train is going slightly slower than he told us before.

Yeh. Thanks. Really good news.

Well if you’re gonna jump off, at least you won’t get hurt as bad.

Yes, and we’re constantly reassured (yearly) that future taxpayers will be richer than us. Thus, they will be more than happy to pay for the new bridge at an unspecified date sometime in the future.

To take the more optimistic view, I think there is some long term hope on three fronts – (1) a more sensible approach toward end of life care including more and more people executing living wills and advance directives, (2) tort reform, at least at the state level, that would include giving doctors safe harbor protection from failure to diagnose lawsuits if they follow evidence based guidelines and protocols where they exist and (3) more reasonable patient expectations helped by the trend toward higher deductibles and the implicit associated reduction of moral hazard.

Jefferson once wrote an enlightened citizenry is indispensable for the proper functioning of a republic.

Generally – including health policy and everything else – it seems to me our republic is not functioning properly. It seems to me our citizenry cannot honestly be called “enlightened”. It seems to me our republic is stumbling into a tragedy of the commons. Optimism?

“I hope it, but I doubt it”.

– Mark Twain

Note to Barry:

I would probably disagree with your 3 factors of potential cost reduction:

a. There are some good articles in Health Affairs which show that the per cent of health costs at the end of life has been stable for a long time.

b. The protocols themselves are getting more complex and expensive, at least as far I can read.

c. Most Medicare patients do not have high deductibles, and do not need to have high deductibles to save money.

Still and all, Medicare costs are falling over the last year or two. I have not read enough on this to know the reason.

Bob, I would probably be able to understand your comment

1. If you posted a link to the good articles in Health Affairs. It’s always beneficial to read good articles. Specifically, it is less important to know that the percentage is “stable” than it is to know how large the percentage is in the first place, and if there may be reasonable means to reduce that percentage.

2. If you posted a link to your source for suggesting that the complexity of modern protocols adds anything meaningful to total cost, especially after considering the value of quality improvements and medical cost savings.

3. If you cited or offered some rationalization for your statement that most medicare patients do not have high deductibles. I would agree with your statement for Medicare Advantage. That accounts for one-third of seniors. The other two-thirds of seniors still have original Medicare- their Part A deductible is something like $1,200 per admission, and the copays after 60 days confinement are still punitively high. The Part B deductible is still roughly $150 plus there is no limit on the 20% share of costs borne by the senior. Plus the Part B “allowable” amount is still based on cost data that are two years old – therefore lower – meaning more cost is not allowed and thereby shifted to the senior. What evidence is there that these are low-cost thresholds even for the 2/3 of seniors still enrolled in original Medicare?

4. If you posted a link to support your statement that Medicare exoenses have been falling over the last year or two. As it is, you seem to be mixing up a lesser rate of increase with costs actually falling.

Note to John:

1. Here are the articles about end of life care:

http://content.healthaffairs.org/content/20/4/188.full.html

http://conversableeconomist.blogspot.com/2015/06/focusing-on-high-cost-patients.html

2. Regarding deductibles in Medicare:

I may have a jaundiced viewpoint. I sell health insurance to persons under age 65. For eight hours a day I present $5,000 deductibles, 50/50 coinsurance or 70/30, and narrow networks.

From that perspective, even the un-supplemented Medicare package of $1200 deductible in Part A and $150 + 20% cost sharing in Part B looks like heaven, compared to what is faced by persons under 65 in the individual market.

3. As it turns out, the so -called reductions in per person Medicare spending are part of a windy Washington exercise in baseline budgets. My fault for getting this wrong….

http://www.nytimes.com/2014/08/28/upshot/medicare-not-such-a-budget-buster-anymore.html?abt=0002&abg=0&_r=0

Bob

We are coming out With an individual product in Oct

Two items of good news

$100 a month funds a $5,000 deductible in 18 months on a paid up basis

And you get fees per family per month on the underlying first dollar coverage

To learn more go to nationalprosperity.com

Don Levit

There, Bob. You see? It’s not hard to post links to the sources you reference. It just takes a little time.

1. The Health Affairs article you posted was published in 2001 and the study it references was based on Medicare data from 1993-1998. Still, it documents stability in the EOL (end-of-life) Medicare expenses over the years, which has presumably continued to this day. The article seems to conclude that there is nothing really amiss with EOL Medicare costs because (1) Medicare EOL costs simply mirror the costs for similarly-situated persons of any age and (2) a stable percentage is not a “driver” of cost growth.

Whut?!

The article’s first conclusion ducks the issue I raised – that stability is not so important as the size of the percentage in the first place, and whether there may be reasonable means to reduce that percentage. I think this is related to Barry Carol’s issue as well. The Health Affairs article does not engage this issue. But is it reasonable to suggest that the Medicare and working-age populations are so similar that they share the same cost problems and therefore will respond to the same cost solutions? My opinion: no. The article’s second conclusion defies logic and arithmetic, suggesting that a stable percentage of a rising total does not somehow reflect one of the drivers of that rising total.

The Conversable Economist article you posted is current, and acknowledges the issue I raised by citing need for “more emphasis on non-hospital, non-high-tech alternatives.” I agree with that generality. But that’s a little like saying tennis players need to break their opponents’ service. Yeah, that’s right. But it’s not helpful.

Helpfulness is advice how to do it. Neither of the articles you present go there; neither responds to the issue I raised.

2. You seem not to have responded to this one.

3. OK, I understand – your perspective is individual insurance and I would tend to defer to you there. My field is group insurance and in my field, Medicare cost sharing has historically been much larger than in the typical employer- or union-sponsored insurance. Besides, the sum total of Medicare cost sharing is larger than it might seem because Medicare contains so many different cost-sharing devices. Example: Medicare Part A cost sharing increases dramatically after 90 days’ confinement, meaning it most affects people having catastrophic expenses, at the very time they most need coverage. Same is true for Part B expenses where there is no limit on the individual’s 20% share of expenses. So Medicare benefits are not so generous as e.g., the administration likes to suggest, even for individuals. If that were not so, there would be little need for “Medicare Supplement” policies. There would be little need for Medicare Advantage.

4. Agree. And Washington is definitely windy.