What is Unique about U.S. Health Care? Lack of Patient Control of Spending

What is unique about American health care? Americans control a smaller share of our health spending than do residents of most other developed countries. More importantly, the share of health spending controlled by Americans, rather than government or insurers, has declined much faster than it has in any other developed country (for which we have measurements) in the last couple of decades.

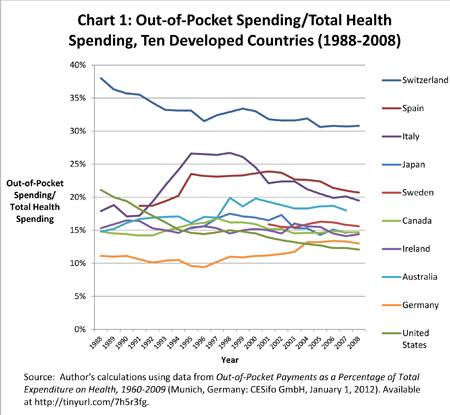

Chart 1 shows the share of health spending controlled directly by patients (also known as “out-of-pocket” spending) in ten developed countries, including the United States, from 1988 through 2008. (Not all countries are represented for the entire period.) Switzerland, a country widely praised for its health care, allows patients to control significantly more of their health dollars than any other country does. Out-of-pocket spending in Switzerland has fluctuated around one third of total health spending since 1998.

Everybody all over the world,

In every nation.

In all other countries, out-of-pocket spending has clustered around 15 percent of total health spending. However, countries are showing different trends. In the late 1980s, the United States allowed patients to control more health spending than any other country, except Switzerland. By 2003, it had dropped to the bottom of the pack.

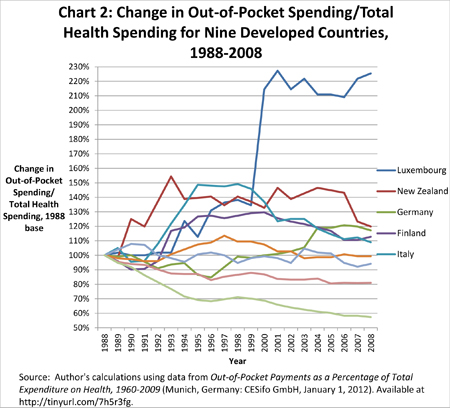

Chart 2 shows the change in the share of out-of-pocket spending for all countries for which data is available for the entire two decades. It shows unequivocally that the United States has been moving in the wrong direction: Removing health dollars from patients’ control and giving it to government and insurers to spend. The share of U.S. health spending controlled directly by patients has dropped by almost half in twenty years. No other country comes remotely close to this failure of consumer direction.

Indeed, only three of the nine countries have experienced a drop in patient control. The next worst is Switzerland, for which the drop was only twenty percent. As noted above, Switzerland has an extraordinarily high share of direct payment, so a loss of consumer sovereignty, while worrying, is less of a concern than in countries like the United States where the share of health spending controlled by patients was already low in the 1980s. Ireland showed a marginal drop in patient control over the period, with out-of-pocket spending as a share of total health spending dropping by about eight percent.

In every other country, the share increased or remained stable over the period. Tiny Luxembourg experienced a large jump in patient control around the turn of the century, but this was from a very low base. (Out-of-pocket health spending jumped to 11.8 percent of total health spending in 2000 from just 7.4 percent the year before.)

In other countries, the increase in patients’ share of health spending clustered around 15 percent over the period. Even in Canada, where government continues to assert monopoly control over residents’ access to health care, the share of health spending controlled by patients directly remained unchanged. As a result, Canadians now enjoy more direct control over their health dollars than Americans do!

The lesson is clear: The United States continues to experience a long-term trend of loss of patients’ control of health spending. Attempts to reverse this with tools such as Health Reimbursement Arrangements, Flexible Spending Arrangements, Medical Savings Accounts, and Health Savings Accounts have not resulted in systemic change.

As a result, Americans control less of our own health spending than do residents of other developed countries. After ObamaCare is defeated, reversing his long-term trend must be the top priority of the real health reform that replaces it.

All scarce resources must be rationed to avoid shortages. In consumer markets, prices are used to ration goods and services. In markets without price rationing, some other method must be used. People hate the thought of the government (or their health insurer) rationing medical care. But if consumers refuse to manage their own health care spending, a third party will have to do the job for them.

The number one objective is crystal clear.

We need to make “medical care”, not “healthcare” the product.

John, This study coinsides with the era of the ‘Copay’, probably the worst idea in healthcare financing in like EVER.

When I have a copay cap my exposure, I want everything, only the best, and right now!!!

Could you imagine your auto insurance premiums if it provided for $50 copays for auto repairs? When I pay $50 at the dealership – why not throw in a tranny serive, brake service, change the plugs, etc – hey I paid my $50, give me everything to keep my car running in top condition, I want the all the best, right now – my exposure is capped – whay should I be a good consumer???

Fascinating post. Good job, John.

John – I tried to go to the source of the chart information but had difficulty doing so. I wanted to see if the underlying data were truly comparable, particularly whether or not the definition of “out of pocket health care spending” was truly consistent between country data. I’m sure you confirmed this, but am wondering if you can link me to the data better than the references in the charts themselves? thanks.

Switzerland makes sense because insurance coverage is usually high deductible. But what is the out-of-pocket spending in Canada and Sweden? Both claim to have comprehensive single-payer sytems?

Very interesting. Mary

@HDCarroll:

The original URL is http://www.cesifo-group.de/portal/page/portal/ifoHome/a-winfo/d3iiv/_DICE_division?_id=6747349&_div=6747630 and it uses OECD data.

However, it does not control for what is out-of-pocket spending, which I think is an important point that I haven’t seen systemically reviewed across the countries.

For example, Canada probably spends much of its OOP on dental care, for which even if a Canadian has employer-based coverage it doesn’t cover everything, just like in the U.S.

My guess is France, for example, has higher spending on physicians’ fees and less on prescriptions, than the U.S., but I cannot say for sure.

We definitely need a review of the components of OOP spending, as well as OOP spending per total health spending.

@John R. Graham

Thanks for your comment and observations on my inquiry. You are pointing out exactly the kind of issues that generated my question. If the “categorization” and classification of types of spending is not the same, there could be some big items being counted that we call something else, etc. France has their official reimbursement rates for professional services, and a lot of out of pocket for what amounts to balance billing if they don’t have gap coverage, as you point out. Thanks again.

How do insurance premiums fit into the out of pocket expense equation? The primary medical concern we have in our family is the skyrocketing insurance premium. For a family of four, insurance through my employer has gone from $788 per month to $1987 per month since 2001. Not only is that breaking the bank, but it changes the relationship between insured and insurer. Even though I know better economically, I tend to look at my medical insurance more as a pre-paid medical plan than as an insurance plan. After all, when you pay less than $1000 for a premium, you think “I’m glad it is there if I really need it.” When you pay $2000 for a premium, you think “I’m going to use it da__it, I’ve sure paid for it!”

If we only look at the out-of-pocket side of the equation, we miss another important driving force in the over-use of medical services.

John, Look into a high deductible health plan, as John Goodman preaches regularly. You’ll have to do some convincing to get me to believe you can’t do better than $2000/m by switching to a HDHP. If you do, then you’ll become a mutch better healthcare consumer, instead of ‘I want the best, all I can get, and right now’ – the same philosophy that is killing our countries cost of care.

We did actually switch my wife to a HDHP when the premiums at my job got too high to afford, but even then we only saved about $150 a month, with a $3000 deductible, so after the employer plan premium there’s no money left over to use it anyway. So, at $450 a month (the absolute best price for a person in her 40s in NV with a $3000 deductible) we still get squeezed.

Of course, if we could convert the whole country to that type of plan, and get rid of so many of the state mandates on coverage provisions, that premium might become more reasonable, and with a medical savings account (which, again, Obamacare regs are making more and more difficult for my wife) we could all become consumers again and the costs would fall rapidly.

In Tennessee, my family (4 people) pays $386 per month for a plan with a $10,000 deductible. I could get a plan with zero deductible for $1,420 per month, but I’d be paying an extra $12,400 per year to buy down a $10,000 deductible, or I could get a $2,000 deductible for $1,118, but I’d be paying $8,800 per year to reduce my deductible by $8,000.

The math never works out, just like with the casinos

Interesting article. Let’s look at a problem or two:

Medicare is controlled by the govt. Reimbursement fees are set by them. The percentage of the population under Medicare is rising with our aging population. But, worse…you can’t get out of Medicare, by govt law, except in rare and complicated cases. So, almost NO patient control. Change? Put choice into Medicare.

HSAs? Don’t blame the patients. Congress limited implementation in many cases, and changing tax laws to fully deduct money put into these is difficult now, and HSA is not an option in many (most?) health insurance plans.

First dollar coverage by your insurance plan takes away some incentive to save…if first dollars were taken from your (tax deductible) HSA, and then insurance were used, savings would be accomplished.

Putting the insurer between the patient and doctor has contributed markedly to cost increases.

Cutting and controlling payments to doctors, who are in a take it or leave it situation with insurance companies (who OWN the patients), is already producing a doctor shortage, and has been one factor in keeping many of the best and brightest away from a career in medicine.

These issues and more have been discussed by many of us, but…nothing substantial has happened. Worse, if Obamacare/Abysmalcare is allowed to stand as law, the situation would rapidly get worse: rationing, longer waiting times, decreased quality of care, less employer based coverage.

May 15 study from the Commonwealth Fund study comparing the quality of the U.S. system with five other countries found that despite spending twice as much per capita, the U.S. ranks last or near last on basic performance measures of quality, access, efficiency, equity, and healthy lives. “The U.S. stands out as the only nation in these studies that does not ensure access to health care through universal coverage,” says Commonwealth Fund President Karen Davis (see BusinessWeek.com, 6/12/07, “Universal Health Care: Say Yes”).

New Harvard study shows more then a half million americans will die in the next ten years because of the lack of Health Care. Evidently not a problem for the NCPA.