The Emerging Market for Medical Care

Two relatively new services are facilitating a market for medical services — with price and quality competition, as well as transparency. We have previously reported on MediBid, which takes a Priceline approach to medical care. Another service, Healthcare Blue Book (HCBB), offers a free service for patients — showing the average price for various procedures in almost every zip code in the country. Moreover, both businesses have created new tools that are valuable for employer plans — especially those with high-deductible health insurance.

MediBid for Patients. U.S. patients willing to travel and able to pay upfront can take advantage of the online service, MediBid. Here’s how it works. Patients register and request bids or estimates for specific procedures on MediBid’s website for the services of, say, a physician, surgeon, dermatologist, chiropractor, dentist or numerous other medical specialties. MediBid-affiliated physicians and other medical providers respond to patient requests and submit competitive bids for the business of patients seeking care. Patients can choose from medical providers in the United States and even some providers outside the country. MediBid facilitates the transaction but the agreement is between doctor and patient, both of whom must come to an agreement on the price and service.

Business at the site is growing. For example, last year the company facilitated:

- More than 50 knee replacements, with an average of five bids per request and some getting as many as 22. The average price was about $12,000, almost one-third of what the insurance companies typically pay and about half of what Medicare pays.

- Sixty-six colonoscopies with an average of three bids per request and some getting as many as six. The average price was between $500 and $800, half of what you would ordinarily expect to pay.

- Forty-five knee and shoulder arthroscopic surgeries, with average prices between $4,000 and $5,000.

- Thirty-three hernia repairs with an average price of $3,500.

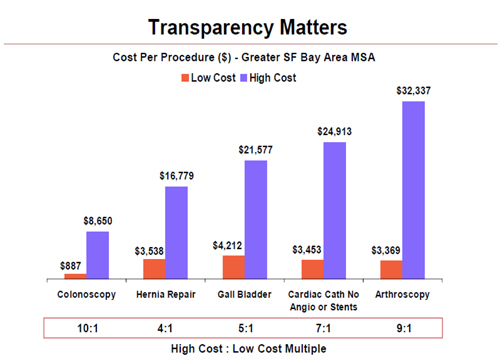

Healthcare Blue Book for Patients. The cost of a medical service can vary by a factor of five or even 10 times in a geographic area or within an insurers’ provider network. [See the figure.]

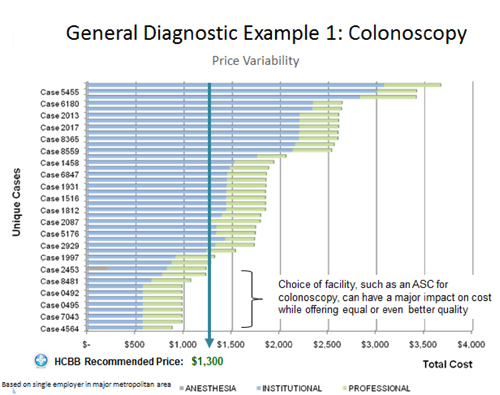

Using Healthcare Blue Book, patients can unveil some of the mystery surrounding what is a reasonable medical price. Healthcare Blue Book tracks a range of prices in each zip code based on claims from its health plan clients. Although individuals cannot see the specific price each hospital and clinic charges for each service, patients can see the average or reasonable price within a given area. For instance, if the Healthcare Blue Book recommended price for a colonoscopy in the area represented in Figure II is $1,300, patients know that is a fair price that is widely available. Moreover, patients know that up to one-quarter to one-third of area providers actually charge less.

MediBid for Employer Plans. Following the MediBid model, employers cover no more than the median cost — requiring the employee to pay excess charges if they choose a provider who charges above the median. Take a colonoscopy for example. The price in a large city varies considerably — and the upper estimates approach $9,000 if the procedure is done at an out-of-network hospital. Health plans negotiate network discounts that are lower, but prices can range from $900-$3,600 for a colonoscopy in the following example that was taken from a Midwestern city. [See the second figure.]

In this example, the Healthcare Blue Book recommended price is $1,300 — which is roughly the average price in the area. In health plans that MediBid designs, the employer only covers up to the recommended price. If the employee chooses a higher cost provider, the employee pays the extra out of pocket. When MediBid gets the employee a price that is lower than the HCBB recommended price, the savings are shared between employee and employer. MediBid (who uses the HealthcareBlue Book service) reports it often helps patients locate colonoscopies prices at less than half of the HCBB recommended price.

Healthcare Blue Book for Employer Plans. Healthcare Blue Book is a valuable tool that helps workers identify specific clinics, hospitals and facilities that have the best prices on medical procedures. Health plan enrollees can look up medical procedures by zip code online (including specific procedure billing codes ordered by a doctor). Healthcare Blue Book displays the median price and a bar graph comparing how costs vary among area hospitals and clinics. In the second figure, enrollees needing a colonoscopy could see that a hospital (identified in this graphic as Case 5455) charges $3,600 compared to an ambulatory surgery centers (ASC) that charges less than $1,000. Employees having a colonoscopy at an ASC could realize savings of $2,500 compared to the most expensive facilities.

That’s neat. I wonder if this will create some industry around medical travel. I know some hospitals have their own hotels and other services — it’s very convenient for patients that way.

Wish they all did, frankly.

Services like MediBid and Healthcare Blue Book have the potential to be game changers! If all employee health plans were designed to make workers pay the marginal cost above the average costs, more people would begin asking simple questions such as: How much does this cost? Once doctors began hearing the same question over and over, it would not be long before they would begin to provide answers. Of course, doctors don’t generally know the cost of treatments or diagnostics they order. But, they would begin to have an idea. In addition, if health plans provided access to tools like Healthcare Blue Book, patients looking for the best price could make the market far more competitive.

In the example above, a colonoscopy can cost from $1000 to $3600 (far more if you’re uninsured). Can you imagine what would happen if every patient who was ordered to get a colonoscopy were to call around, or merely look on a website that showed that the local hospital outpatient department was three times as expensive the local Ambulatory Surgery Center? Hospitals would begin losing business to more competitive firms. As a result, they would have to offer competitive pricing. This would be a game changer.

Although MediBid does have facilities registered in 10 countries, it is not always necessary to travel in order to save money. Sometimes simply crossing a state line helps due to medical boards which have rules in different states, but we can often find in state facilities willing to compete on price and quality.

…is not always necessary to travel in order to save money. Sometimes simply crossing a state line helps…

@ Ralph

For that matter, if more patients expressed their willingness to merely drive across town to save money (or even across the street from an expensive provider to one that’s less expensive), over time there would be less need to travel. Merely demonstrating that most patients price sensitive would prompt more doctors and clinics to offer competitive pricing.

“MediBid, which takes a Priceline approach to medical care.”

It’ll be interesting to see how this works.

Unfortunately, the administration is clearly hostile to free markets, will do all it can to kill market forces that might bring down the cost of healthcare, in order to drive toward their goal of a single-payer, European style system. I notice that none of the Hollywood celebrities or progressive politicians damning the bad US Healthcare system fly to Canada or Britain for treatment if they get cancer or some other life threatening illness. I will link to this from my Old Jarhead blog. (www.tartanmarine.blogspot.com)

Robert A. Hall

USMC 1964-68

USMCR, 1977-83

Massachusetts Senate, 1973-83

Author: The Coming Collapse of the American Republic

All royalties go to help wounded veterans

For a free PDF of my 80-page book, write tartanmarine(at)gmail.com

Cost analysis of health care can not possible work like priceline..

@buster, you are right

@erik. it is currently working. Not sure where you get your informaiton

Erik, your a killjoy.

@ Erik

You’d be amazed at the effect angry patients would have on their doctors’ (and local hospital’s) behavior, when patients are balance-billed for $2,300 because they didn’t ask questions and select a facility that was price competitive. At first glance, it sounds a little messy to expect patients (physician order in hand) to call around asking prices or looking up providers on a website. But, it would only be cumbersome initially. When patients find they are expected to pay, say, $2,300 out-of-pocket, because their doctor directed them to a hospital outpatient facility for a colonoscopy, they will become very angry. When busy physician offices start getting calls from angry patients, who are mad because they were needlessly directed to an over-priced facility, doctors will begin to advise patients that prices vary. At the same time, when hospital business offices begin to get calls from angry patients because the hospital outpatient facilities charged them $2,300 more than the free-standing clinic down the street, the hospitals will begin to realize how angry customers and bad publicity are bad for business. These uncomfortable, messy situations are what force people (doctors, hospital and patients) to become more price sensitive and price competitive.

We also created an online cost transparency and support service called MyHealthandMoney.com that is offered to employers and consumers. After spending years on the provider side of healthcare, I knew that moving costs downstream to end users put most patients in the precarious position of owning costs that they didn’t know how to control. When a patient is diagnosed he/she has no idea the size of the problem so services like ours and the others you cited will become increasingly important as employers move to plan designs such as CDHP’s or direct contribution benefits.

@studebaker

Good point. And docs have no more access to that info than patients do. That’s why at MediBid, we not only offer transparency, we offer real competition in medical care. The patient can see in advance not only how much, but the education, training and experience of the doc.

At bottom, MediBids is a well-designed evolving small business model. Ralph Weber and his wife are extremely smart, ethical and dedicated to the best interests of both doctor and patient.

However, there are the inevitable problems that MediBid faces include:

1) there are many different potential database designs that defy legal proprietary “protections” to accomplish the same goals. If, for example, a giant player like Pri-Med [which has online CME and in-person conferences with very large numbers of participating physicians and just bought Amazing Charts] decided to compete head on with MediBid. . .what would happen?

2) many doctors at the top of the food chain are not just expert at cannibalizing doctors lower down – they enjoy a Machiavellian obsession to control the marketplace. Can they sabotage the MediBids model as it presently exists? Yes. . . but they don’t need a roadmap posted here.

To date, the Webers work very hard to stay ahead of the inevitable vulnerablities of the MediBid model, and are to be congratulated.

Dorothy Calabrese MD

Allergy & Immunology, San Clemente, CA

very interesting-i think there will be a market for medical travel considering how some insurance plans are offering to pay people to go elsewhere to get treatment

Now if MediBid would also do a package deal with a hotel, car rental, and recommend local attractions we could turn this into true medical tourism.

@Robert. We can. Many of our facilities do that for the patient, so for us to do it every time would be unnecessary duplication of cost and effort, but we do ask every patient.

I agree with Ralph that what we need is transparency in prices. That would bring down the costs, but not enough unless:

1) Our govt opens up the free market to work by lessening or eliminating all the health insurance mandates. These mandates are really just give-aways to thier crony supporters. An easy solution would be to mandate insurance companies offer riders to their policies, but not mandate that they are included.

2) Patients must have skin in the game in respect to their own healthcare. How much skin can be debated, but there is no reason why an insurance deductible can not be means tested.

There are other suggestions, but they will be in my book, due out right before our president creates another crisis and tries to nationalize the system further into a single payer. So I probably won’t make a dime for my efforts ; )

@Dorothy, thank you for your kind words. Anyone entering second to market will encounter pitfalls we did, so we do have a “head start”.

@DocSH. It’s all about making medical care the product, not the healthcare financing scheme

Devon. This is a fascinating post. I think price transparency could be a real game changer.

Ideally we would want this by facility. But having some idea of what things tend to cost in one’s area is a good first start.

John,

As you know, I’m a macroeconomist, not a health economist, so there are lots of things about health economics that I don’t know. One of them is the explanation for the phenomenon of various health providers charging much higher prices for people who are not insured than for people who are insured. What is your explanation for that? Can you give me a few references, such as a prior discussion on your blog or a few journal articles?

Thanks

John

@John Seater,

Providers have “list prices” and all the payers pay discounts from that base line. An unsuspecting uninsured person might assume that the list price is the price everyone else is paying, when in fact no one is paying it. On the other hand, a smart shopper paying cash can often get the provider to give him the lowest price charged anybody.

John

@Goodman

At Healthcare Blue Book we do find that informed cash paying patients can get good pricing (below health plan levels) for many out patient services. In-patient services are more difficult but will improve as transparency increases.

@ Reinhardt

The Healthcare Blue Book version for Employer Plans that Devon writes about at the end does specifically show patients where they can go to get a fair price. Each facility is listed and they are ranked by their price allowing patients to consider where they want to go by knowing the price on the front end.

Jeff

Hi, All–Some observations on this topic:

1. Competing on price is not the same thing as reducing costs. And influencing prices one patient at a time is not as successful as doing it on purpose for all patients.

2. The biggest opportunities for competitive price marketing is to select the setting–choosing an ambulatory care setting, not a hospital, even if it is a procedure done in a day surgery. The facility fee will reflect hospital overhead.

3. Recognize that the only retail pricing that can be assured will be for elective minor procedures, testing and the like. Serious cases with unpredictable acuity and intensity of care are rarely pre-priced, unless it is to ask for a deposit against the eventual bill, as happens with Canadian patients who come to US hospitals for bone marrow transplant.

4. Prices vary for reasons in addition to sheer greed, as some like to label anything that look high. Other reasons can be extra-high capital costs because the building is new, higher labor costs because of a teaching program or unionized healthcare workers (see the California Nurses Association in their current pattern of strikes against Sutter Health); regulatory mandates of both benefits and process requirements that can add a third to the costs, and the state of medical malpractice law. Go to a southern state with right to work laws.

5. It matters whether a doctor is in a free-standing practice or in an integrated group. In the latter, there will be additional administrative and financial staff and more of a fixed set of charges. But there is also quality oversight.

6. For serious cases, pay more, as by actual analysis recently, the higher priced teaching hospitals have remarkably higher outcomes than community hospitals and physicians who are not on a teaching facility. For really serious work, travel to MD Anderson, The CLeveland Clinic, Mayo, Geissinger or another of the mature integrated groups.

7. Choose providers with a low percentage of government patients as they will not have to include the cost-shifts from those programs. Those will get worse soon.

The industry, the government and the public also need to collaborate with cool deliberation to strip out such things as superficial and ill-considered regulations (2-day stay required for normal deliveries.) inclusion of “feel good” requirements in provider costs (use only wood products from certified forests); and lots more.

Note that the high deductible policies are so popular because they reduce expenditures by as much as 30%. (‘ray Goodman!) This is a step toward having patients

take responsibility for their primary care, leaving other care to be covered by a “major medical.”

It is good to become an activated patient, as it does have an impact on physician behavior. I have fired several physicians who did not honor their appoint-ments, who advocated for procedures I did not need, and who wasted my time with old-fashioned paper charts, with my information being entered by myself, the clerk and the doctor before we even got to the examination.

It is also good to be aware that as Obamacare rolls out, prices will increase severely–don’t blame the providers or health plans.

Happy Thanksgiving and stay out of the healthcare system if you can.

Wanda J. Jones

President

New Century Healthcare Institute

San Francisco

@Wanda, re number 1. The market does not function properly using price fixing or price controls

Medibid is what the healthcare marketplace needs. ie. transparency and competition.

Wanda, you raise good points but I would not fire a doctor for using paper charts. I work at a facility with electronic medical records. They are less private than a paper chart. Although I do not abuse the privilege, I am a few mouse clicks away from any patients record in our huge health care system. The same is true for virtually any employee in the system. As a patient, I find that frightening. It is a lot different from the days when you had to go down to the file room and request a file with a reason.

Because there is now no true doctor-patient confidentiality, if I ever have to go to the ER as a patient, I have decided that I will tell them what they need to know to deal with my presenting complaint. Nothing more and nothing less. The marketplace did not demand electronic records. It was mandated by the government.

Suppose you were to get 15 bids on remodeling your kitchen. Would you automatically take the lowest quote or even any of the lowest five quotes? Rarely, because the issues of quality and reputation are part of the consideration. How much more so are those concerns when dealing with your health or the health of your family? I am all for price transparency. When we ultimately add real indicators of quality (no. of procedures performed anually, outcomes, etc.) then we will have a marketplace where fully-informed decisions can be made.

@ Wanda

I appreciate you taking the time to compose a lengthy, insightful comment. If you don’t mind I would like to respond to a couple of your comments with comments of my own.

Competing on price is not the same thing as reducing costs. And influencing prices one patient at a time is not as successful as doing it on purpose for all patients.

Health care is an example of how an industry does not compete for customers on price unless consumers force them. The health care industry does not compete on price because few patients pay their bills directly. By contrast, the government, employers and insurers are all trying to restrain costs “…on purpose for all patients…” with little success. For that reason, I would argue that it just about has to be consumers “…influencing prices one patient at a time…” (multiplied by 300 million consumers). Firms that are forced by consumers to compete on price are generally also forced to control costs and maintain efficiency in the process. On the other hand, just because a firm is able to reduce costs does not mean the savings is automatically passed on to consumers – unless the firm is competing on price. In a firm that is not competing on price, the difference between (higher) prices and (lower) costs will be retained as (excess) profits.

The biggest opportunities for competitive price marketing is to select the setting…

I agree with your second point that choosing the facility is where most cost savings will be realized. Just because the hospital has a higher cost structure does not mean I should be willing to pay the hospital $2,000 more for a CT scan than the same scan at the freestanding facilities near the hospital. When enough ambulatory patients bypass the hospital for the neighboring facility, the hospital will figure out a way to cut costs and lower prices. Maybe the hospital will close down and its business be absorbed by an assortment of neighboring facilities that are efficient at what they do -– and do little they aren’t efficient at.

Recognize that the only retail pricing that can be assured will be for elective minor procedures, testing and the like.

Yes, I agree that people probably won’t check HealthcareBlueBook on their iPhone to compare the price of cardiac care from the back of an ambulance in route to the hospital. But I don’t believe they have to in order to affect a change in doctor/hospital behavior. Merely inquiring about the price ahead of receiving a service; balking at the price; and getting the ambulatory tests/scans/procedures at lower-cost facilities that are competing on price will help perpetuate an environment where providers assume patients are cost-consciousness. This will leave fewer (major) procedures for insurers to haggle with hospitals over. If doctors/hospitals have to compete on price for CT scans/lab work/ etc, it will be harder for them to bury hysterectomies under an opaque, voluminous hospital bill where the list price is a fraction of the actual price; and the price paid bears no relationship to actual costs.

Prices vary for reasons in addition to sheer greed…

I agree. The same is true of malls where I shop, grocers where I buy food, and mechanics who service my cars. The Big Lots! near my house has cheaper real estate, and a less trendy locale, than Willow Bend mall also near my house. Yet they all compete on price. Big Lots! competes primarily on price, whereas The Shops at Willow Bend emphasizes amenities, quality and exclusivity — at prices that are competitive with other overpriced, trendy malls. Price isn’t always the only consideration – but as a marketing professor told us in graduate school, price is always a consideration.

Overhead will vary depending on the location and the type of facility. But when getting CT scan or a colonoscopy, that doesn’t mean patients should willing overpay for services obtained at the local hospital to help it cover its higher overhead, its cost-shifting; or its money-losing services.

Regards,

Devon

If insurance companies continue to give patients incentives to go get treatment elsewhere, I wouldn’t be surprised if we start (if we haven’t yet) having an exponential growth in the market for medical travel. Whether it is across state lines or traveling to other countries, price transparency allows for patients to spend their money wisely…which ultimately should be everyone’s goal.

@Scott, you’re right, and rarely do we see anyone going for the lowest bid. Value does not equal cheap in a market. Value equals a balance pf price, quality and convenience.