Back in the 1960s the major form of poverty alleviation was cash welfare… this is included in the incomes of those who are defined as poor. The poverty numbers from the 1960s are therefore the number of people who are still poor after we’ve helped them.

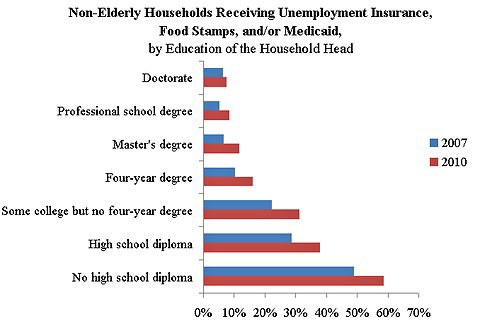

Since then … we’ve had a bipartisan move to stop just giving money to poor people and start giving them what we think they need. We give help with housing vouchers known as Section 8 vouchers… Food Stamps existed before but the program has been greatly extended. Medicaid, that free health care, is not included in household income either.

The EITC is the country’s largest poverty alleviation program and we don’t count its effect in reducing poverty at all.

Because, just as in the 1960s, we count peoples’ market and direct cash grant incomes when we place them below or above the poverty line. But we’ve moved our major methods of poverty alleviation from that direct cash assistance to those goods and services in kind plus aid through the tax system, all things which we don’t count when we place people above or below the poverty line.

Full story on the new U.S. poverty numbers here.