Austin Frakt and I Agree on Something

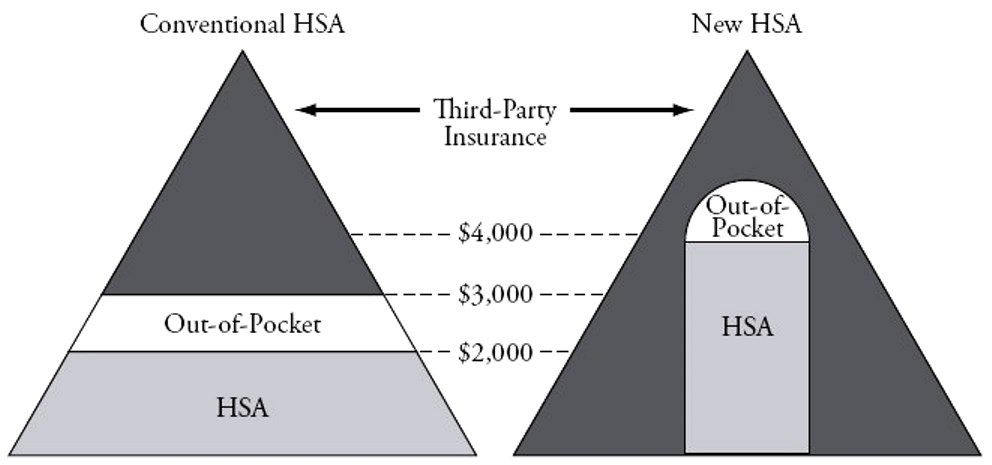

Across-the-board deductibles don’t make a lot of sense. In Priceless, I argued that whole categories of care should be transferred to the patient in some cases and there should be first-dollar coverage for other kinds of services. Austin Frakt seems to agree, reproducing this graph from the book, and remarking:

LASIK is an elective procedure, the purpose of which is well understood by the patient. I’m on board with the idea that insurance shouldn’t cover such things, or if it does, not the full cost and certainly not the marginal cost. All health procedures just like this are good candidates for the purview of John Goodman’s “New HSA.”

The issue is not whether the procedure is like LASIK surgery, however. The issue is whether choices by the individual will create costs for other members of the insurance pool. Where there are no “financial externalities,” the case for individual decision-making is strong.