Shrinking Health Construction Spending: Consolidation to Blame?

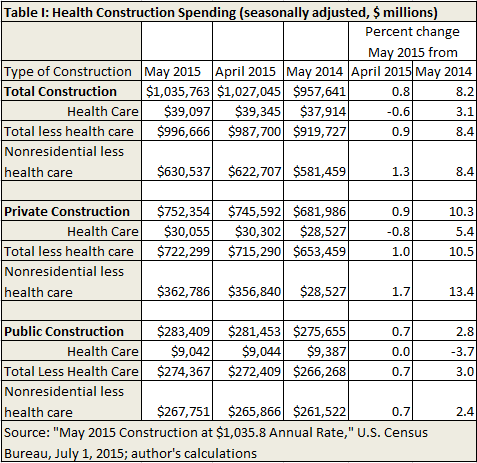

This morning’s release of construction spending from the U.S. Census Bureau indicates spending on health facilities actually shrank a little in May, a significant downturn from the previous release (see Table I, below the fold). Total construction spending amounted to about $1 trillion, of which $39 billion was health care. Health construction spending shrank 0.6 percent from April and grew only 3.1 percent year on year. Total construction spending, less health, grew 0.9 percent on the month, and 8.4 percent year on year.

We look at this because other economic data indicate that health spending is consuming more of our prosperity. Low, even shrinking, spending on construction of health facilities may represent the consolidation of hospitals that many fear will lead to increasing prices.

Separating the data into private and public spending, health construction spending increased at half the rate of total construction spending less health care, year on year. It shrank on the month. Other nonresidential spending has increased significantly faster than health care. Public construction on health care has shrunk, year on year.

The game in “health care” continues to be a contest of scale.

This didn’t start recently, it’s been going on since at least the 1980’s. Paul Starr wrote about it in 1983, in his Social Transformation of American Medicine. Individual physician practices have virtually vanished. Hospital system mergers are frequently on the business pages.

It’s a spy vs. spy environment; whoever gets the upper hand, however fleetingly, has a cost advantage and thus a pricing advantage.

Scale can help to wring out admin costs and that’s important. But scale does not really get at the underlying costs of delivering medical care. Each patient needs the same intensity of care whether in a small group practice or a large one; whether in a small hospital or a large hospital system.

When the gains of consolidation are wrung out, what’s next?

I think at some point the nation must answer this question: why are medical delivery costs higher in the US than in other countries? The answer is clearly not scale.

But look at trend data on hospital utilization. Total discharges are DOWN in spite of increased hospital cost. (Because we are getting better OUTpatient care than ever.) Hospitals had BETTER cut spending. And we need to remove the Stark prohibitions to give those bloated money pits some competition.

I think the most likely reason that hospital construction has slowed is that there isn’t as much need for incremental capacity as there might have been previously.

With respect to scale, part of it relates to being better able to afford investments in electronic technology which is becoming increasingly important. The ability to manage population health, especially patients with chronic diseases like CHF, COPD, diabetes, asthma, hypertension and depression, is also probably easier for a large physician group which can more easily afford not just technology investments but also social workers and nurse case managers.

Hospital consolidation was mainly about enhancing market power to extract higher prices from commercial payers. Now, however, those payers are also consolidating which should create sufficient countervailing power to push back against hospital pricing that significantly exceeds value delivered.

That is what I hope, but I decided to take the skeptical route in my headline.

What do Assurant, Coventry, John Hancock, Lincoln National, Maxicare, Metropolitan, NYLCare, Oxford, Pacificare, Prudential, Travelers, and US Healtcare have in common?

I expect Aetna, Cigna, Anthem, Humana and United to consolidate down to three companies and steadily gain market share from there along with the non-profit Blues and Kaiser.

More hospital systems may offer their own insurance plans limited to the hospital’s own narrow network of doctors and hospitals.

s a simple matter of value: Since ussed cars

are worth less than their new counterparts, it costs an insurer much less to compensate ffor the value of a userd car iin the event of theft or irreparable

damage. t like the idea oof buying cheap body kits without

knowing how they will look on your car you have some interesting optioins to

try out. It keeps us upfated and in touch with the atest technologies, too.