Oscar and The Changing Health Insurance Landscape

![]() (A version of this Health Alert was published by Forbes.)

(A version of this Health Alert was published by Forbes.)

Yesterday, the Senate Judiciary Committee’s Subcommittee on Antitrust, Competition Policy and Consumer Rights held a hearing on “Examining Consolidation in the Health Insurance Industry and Its Impact on Consumers,” at which the CEOs of Anthem and Aetna testified. Both of these health insurers have announced friendly take-overs of two other insurers, Cigna and Humana.

One indicator regulators use to determine whether a business combination will reduce competition is whether there are significant barriers to entry in the industry. If there are, new competitors will not exploit openings created by incumbents’ consolidation. During the hearing, the CEOs of Anthem and Aetna each (independently) pointed to Oscar, a new health insurer with highly pedigreed investors, as evidence that health insurance is an easy business to enter.

Oscar is indeed an interesting enterprise, which has attracted fawning coverage in the business press both for its innovation and the quality of its investors. Nevertheless, Oscar is a curious start up, because it focuses exclusively on a market – Obamacare exchanges – in which insurers are taking on a lot of pain.

As I noted in a previous column, health insurance combinations are fraught with political risk. Although viewed by investors as being in a winning position due to the Affordable Care Act, health insurers have provoked Republican lawmakers into a largely hostile stance. This became apparent during Congressional hearings about Obamacare’s “three Rs” – risk adjustment, reinsurance, and risk corridors – in which health insurers were challenged to explain why taxpayers who now bear the legal obligation to buy health insurance must also be on the hook for losses health insurers suffer in Obamacare’s exchanges.

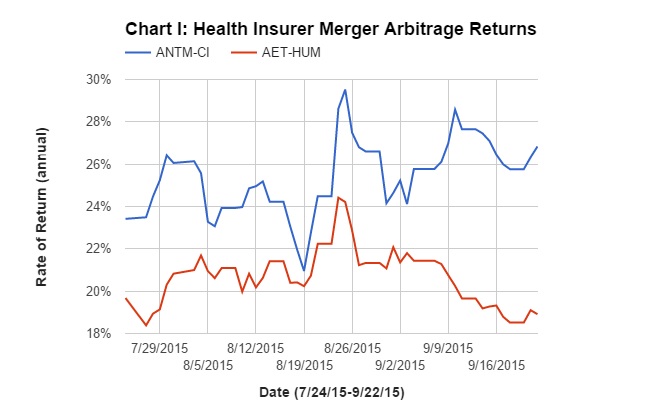

In this environment, it is not surprising investors are skeptical these combinations will close as announced. Chart I shows the expected rates of return for investors shorting the spread of these two deals, as they have changed from the shares’ closing prices on June 24 (the date Anthem’s bid for Cigna turned from hostile to friendly) to last Friday. Each rate of return assumes it will take until the third quarter of 2016 for each deal to close.

Anthem’s takeover of Cigna indicates a return of 27 percent to the merger arbitrage and Aetna’s takeover of Humana indicates a return of 19 percent. These extremely high risk premiums largely reflect political risk: No politician wants to be blamed for loss of choice among health plans.

With respect to Oscar, Obamacare exchanges are poorly designed, so they motivate insurers to compete by offering plans attractive to healthy people, not sick people. Unfortunately (for the insurers), they largely fail to achieve this goal, disproportionately enrolling sick people instead. Because Congress finally managed to limit taxpayers’ liability for health plans’ losses in Obamacare’s exchanges, participating insurers have been losing lots of money. This is why double-digit premium hikes have been announced for 2016. In 2017, the taxpayer-funded training wheels come off the exchanges, and participating insurers will have to cover their losses solely by moving money among themselves.

Into this minefield springs Oscar, which came into existence specifically to compete in Obamacare exchanges and has raised capital at increasingly rich valuations. In 2014, Oscar’s revenue (earned entirely through New York’s Obamacare exchange) was $56.9 million, of which it lost $27.6 million. Oscar appears to want to make it up on volume. Currently offering plans only in New York and New Jersey, it will soon expand to other states, especially Texas and California. To fund this expansion, it has raised money from highly pedigreed institutional investors. Last week, Google Capital invested $32.5 million, valuing Oscar at $1.75 billion. This is an increase from a $1.5 billion valuation at its previous raise of $145 million last April.

Some of the press around Oscar reads like we’re talking about Zappos, the online shoe store. Apparently, its online greeting of “High, we’re Oscar” and “minimalist” website count as remarkable innovation for health insurance. That is true, but does describe a path to profitability. It is important that Oscar offers free Misfit activity trackers and Amazon gift cards as rewards to beneficiaries who stay fit, because that increases the likelihood that Oscar attracts healthy, not sick, applicants. Nevertheless, its first-year experience in New York shows this is not enough.

Maybe Oscar simply hopes to show incumbent insurers how to attract individual subscribers, and sell itself to the highest bidder once Obamacare exchanges become a profitable business. However, that is an unlikely prospect. The exchanges are in a nasty political tangle the current Congress has no interest in unravelling.

I hope that I am wrong about Oscar, because health insurance needs customer friendly innovation and a thriving individual market. However, that outcome requires a very different health reform than Obamacare.

It’s not surprising that it takes a few years for insurers to get the hang of estimating actuarial risk in pricing health insurance policies that must be sold on a guaranteed issue basis with only age rating allowed along with a surcharge of up to 50% for smokers.

The biggest barrier to entry, in my opinion, is the need for critical mass to be able to negotiate reasonable reimbursement rates with large hospital systems that have significant market power in their local or regional market and with large physician groups as well. Interestingly, more and more hospital systems are entering the health insurance business, albeit with narrow network products designed to keep as much care as possible within their own system.

In theory, the hospital system could charge its own insurer significantly less than it charges outside insurers for the same care but still get reimbursement rates that are well above the cost of providing the services, tests and procedures. This approach could allow it to charge competitive premiums even if it still insures comparatively few people.

Since people who buy insurance on the exchanges are extremely price sensitive and therefore relatively accepting of narrow network products, this could be a reasonably effective strategy to provide competition to the three largest public insurers if the two deals under review are approved or five largest if they’re not approved.

There are more provider-based plans, but I think the internal conflict of interest between the hospital executives and the health plan executives is a hard one to overcome. Historically, few have succeeded.

Anthem doesn’t care about the Exchange because they make their money on employer-based health insurance. In Indiana, their home state, taxpayers are paying Anthem $33,000 a year for a State employee with family PPO coverage. A family is anything other than a single. So, a 30-year-old male with a child would cost $33,000 a year, I kid you not.

A 30-year-old couple with two children could get insurance on the exchange from Anthem for $784 a month or $9,408 per year (zip code 46113). If this family earned $65,000 per year the Federal Tax Credits are $439 a month which drops the families cost to just $344 a month. The best part for the employer is that their cost drops to ZERO!

I’m surprised that you NEVER write about dropping America’s employers cost to ZERO John because that would make the economy BOOM like never before. Besides, the Feds lose $9,999 a year on the current $33,000 over-priced premiums so the cost for the Feds is actually much cheaper. The Feds lose Payroll Tax (15.3%) plus Income Tax (15% – much more on you John) for a total of 30.3%. $33,000 X 33.3% = $9,999 which is much more than the credit of $5,268 ($439 X 12 = $5,268). So, the Feds cut their cost by almost 50% and the State drops their cost by 100%!

Blue Cross has the State employees, the city employees, the county employees, Medicaid, the Childrens Health Insurance Plan (CHIP), in short – Blue Cross is a giant Fascist MONOPOLY that buys the politicians of both parties for just millions and they get a return of BILLIONS and BILLIONS.

Lucky for Anthem, Blue Cross, that nobody ever writes about how they control the politicians in America. Blue Cross spends more on politics in Florida than any other entity. That’s right a government contractor spends more on politics than anybody else.

Before Obamacare a 30-year-old male with a child could get HSA health insurance for $100 a month in most states from TIME, America’s oldest health insurance company. But of course TIME is closing operations in a couple of months because Obamacare Killed them. Anthem didn’t want to buy an Individual insurance company that was in 44 states, more than any competitor. This is the age of Employer-Based health insurance companies.

Actually, I’ve written a few articles on the cost of public-employee benefits and how they get away with it.

In your State employee example you do not mention the funding used. Most large accounts are ASO, which means that it is the richness of benefits and utilization that drive the annual cost. Anthem likely earns a fee for administering the plan.

Thanks for your post, Ron.

Let me add a couple of points:

1. A $784 family plan would have at least a $6000 deductible, no drug coverage under the deductible, and a very narrow network.

The State health plan you reference is many times more generous, and is filled with age 55+ state employees.

2. Insurers do not necessarily make huge profits on big groups. The bidding can be intense and there are a lot of large claims.

3. You are right that it might make sense for regular employees to migrate to the exchanges. Some Democrats wanted this actually.

But this would have meant more spending on subsidies, which

Blue Dog Democrats and Republicans opposed vigorously.

1. This 30-year-old couple with 2 children can get a $3,000 deductible PPO that pays 100% for $329 a month. I know because I sell it. This has the PHCS.com network with 700,000 docs in the network. I used over-priced Anthem on the Exchange to compare against their over-priced state group that the taxpayers are being forced to pay.

2. What? This post is about Anthem paying $48 BILLION for Cigna so there would be even less competition. Anthem makes HUGE profits, get real.

3. I contacted my State Senator today and informed him that the 3 counties in his district all have Blue Cross for employees that do their open enrollment in August. Now these employees can’t buy on the Exchange in the summer. When open enrollment comes on the exchange on Nov. 1 they can’t drop their employer insurance. This is a scam. I talked to a school teacher in Texas 2 days ago that is paying $1,500 a month to add her family to the school’s insurance and she can’t get out of it.

4. Anthem is spending the BILLIONS because their business model is to terminate sick employees when they can’t work full time, their legal eligibility requirement. It’s tough for women to work when they have ovarian cancer so that is the best time to terminate their health insurance. This saves Anthem a bundle of cash to do mergers and to bribe politicians.

The taxpayers and citizens are being scammed to the max and you want state employees to have a ZERO deductible on RX.

It’s hard to find a Non Profit Think Tank in America that still believes in FREEDOM. The Heritage and FREEDOMWORKS want Individual Health Insurance to take employer-based terminations without medical underwriting. I would think Allen West would call out Jim DeMint and tell him he is destroying America with his Fascist Obamacare ideas.

I told John Goodman in 1997 that he should point out that employer-based health insurance is dangerous with their terminations of their sick employees. The NCPA just can’t see the problem and never would discuss it.

I’d like to hear more about what differentiates this policy from ESI and exchange-based health plans. You’re saying it pays 100% after the deductible, so max out-of-pocket equals the deductible? No underwriting and no benefit cap? How narrow is the network? Is it 100% of an unrealistically low reimbursement schedule?

Bart, I gave you the network with 700,000 docs coast to coast, PHCS. Why would you say, “How narrow is the network?” I said it pays 100% after the deductible and it is a PPO. If your question is what is the penalty for going out of network, that I would understand.

In Texas the penalty for Cigna going out of network is $18,900 plus the deductible. The penalty for Blue Cross PPO is $19,400 plus the deductible. Our penalty is $6000 plus the deductible. Of course Blue Cross is TERMINATING their PPOs in the Individual Market in Texas in 2016.

Because the sick Texans all migrate to Individual Insurance after they lose their employer-based plan Blue Cross will only let employer-based plans have PPOs.

You and your ESI. I make the client sign a statement that says it’s not ESI just like I have been doing for years.

Just go to PHCS.com and do a doc search for any zip code.

“In Texas the penalty for Cigna going out of network is $18,900 plus the deductible. The penalty for Blue Cross PPO is $19,400 plus the deductible. Our penalty is $6000 plus the deductible.”

Well Ron I think I take your point – and at the same time I think, for most of us, these facts you cite don’t matter.

That’s because the great majority of us do not go out of network in the first place. Health plans include greater cost-sharing out-of-network to incentivize in-network usage, not to “penalize” their members. That seems to work. Out-of-network penalties certainly do get applied; but most people never face one.

I’ve always advised clients and others who are unwilling to change physicians, to avoid enrolling in a health plan in which their own physician does not participate. That is usually possible despite the growing number of physicians whose practices are full, or who decline to participate in any network.

But what if there is no choice and you have to change physician? Is that really so difficult or a big problem? Sometimes yes, usually no. I and my family have changed physicians several times, due to job changes and moving about the country. Again for most of us choosing another physician is not usually a big deal. And yes, it could be a bigger deal for some people with chronic conditions even given PHCS’ enormous network.

But the point is, even though there are exceptions I think the drastic penalties you cite are far from the norm, and most people never encounter them.

John, they mattered for my son about 18 months ago when he had a $250,000 surgery to remove 10 inches of his intestines. In the middle of the surgery they had to bring in a surgeon who later we found out he was out of network. He billed $35,000 for his help in the operating room. If my son had an HMO like you suggest, that pays NOTHING for out of network, my son would have owed his deductible plus $35,000. Lucky for my son that his Mom is so smart about health insurance and he is on the same plan at 34-years-old that he had when he was diagnosed at 17-years-old. I know you will now say that most children don’t need a Dependent Conversion Privilege but lucky for my son my wife would not have listened to you.

I know how insurance agents sell HMOs that pay nothing when you go out of network. Your reasoning probably works for a lot of people. I tell people if you get sick your present doctor will send you away to a doc who knows what he is doing. My little brother was diagnosed with TN and trust me, this is a big deal to him and he went to the Mayo Clinic to try and find help. Most guys like you say, “OH, with that PPO you will have to pay 2 separate deductibles if you go out of network.” What you fail to say is that if you go out of network with this HMO you will get NOTHING, which would be Full and Proper Disclosure, which you are required to do with your license. It’s also an ETHICS deal John, which is also required by your license.

Your insinuations about other people’s ethics are tiresome and out of place. And, in my case entirely false. It makes me wonder about everything else you post. You jeopardize your own credibility.

I think my prior comment was quite clear. Why do you suppose I advise not to enroll in a plan if your physician is not participating?

Besides that, one of the two events you describe involves a hospital’s decision to bring in a surgeon who was not in the patient’s plan. That’s a real problem and I think you are aware that problem can arise regardless of the size of the out-of-network deductible. I still say for most of us, the facts you cited don’t matter. And I say the two cases you cite don’t negate what I say. They are the exception, not the rule.

John, you said to me, “I’ve always advised clients and others who are unwilling to change physicians, to avoid enrolling in a health plan in which their own physician does not participate.”

I assumed you were a licensed insurance agent and were bound by ethics by state law. So I give you an example where it does make a difference with out of network charges where an HMO would pay NOTHING.

But, you insist and say, “They are the exception, not the rule.”

Clearly you are not licensed and are just a blogger who is not bound by ethics and can say any foolish thing you want.

You further did assert, “But what if there is no choice and you have to change physician? Is that really so difficult or a big problem? Sometimes yes, usually no.”

So if your daughter has cancer and you can’t go to the hospital with higher survival odds you would tell the parents, – “Usually children don’t get cancer so usually it’s no problem.”

Blog away John, do you have any other opinions you might want to share how people usually don’t get sick?

Yeah Ron, whatever.

I’m just trying to find out how your PPO can sell coverage for half the price of the Anthem policy. Apparently your PPO is better than Anthem in every way. Does this mean Anthem is pocketing the difference and their medical loss ratio is less than 50%? It would make more sense if you told me your plan was underwritten.

Maybe the pools are different– large employer plans seem not to use age banding. At least in California small company plans did last time I worked for one– I wonder if that would be a better comparison.

The Anthem-Cigna merger kind of fits with Bob’s comment– that bidding is intense enough that the companies think they can benefit from a reduction in competition. If Anthem is making huge profits now, it will be making more in a couple of years.

I doubt very much if the state plan is fully insured. The state technically is the insurer here and would control the cost to employees

I see Donald, the state just tricks these employees into paying $33,000 on the COBRA because they are sneaky. Is that the way Donald Trump does it too?

Are all of the cities and counties tricking their employees as well?

I think for transparency the city, county and states should make clear to the citizens how much they are paying Blue Cross instead of keeping it such a big secret to the voters.

Miami-Dade county is really tricking their employees into $41,000 a year COBRAs. Remember, Blue Cross spends more bribing politicians in Florida than anybody else. Blue Cross wants $51 BILLION in Medicaid money and if they get it they will give us citizens their so-called value.

“I see Donald, the state just tricks these employees into paying $33,000 on the COBRA because they are sneaky.”

Nobody is tricking anyone. My former employer was always self-insured most recently with Highmark Blue Cross handling claims and other tasks under an ASO contract. When I retired, I picked up COBRA for five months for my wife until she aged into Medicare. My cost was $437 per month for the first five months of 2012 based on the company’s average cost of insuring its active workforce priced on a community rated basis. Since our company has an older than average workforce, I thought she might be able to get a better deal through Horizon (NJ) Blue Cross. Their quote: $722 per month for coverage that wasn’t as comprehensive as my employer’s self-funded plan. While I made my check out to Highmark as the administrator of the plan, my employer received the monthly premium less the ASO fee.

With respect to your example of family coverage that a 30 year old could buy for $329 per month, I wonder what the premium would be for someone 55 years old or older. I also wonder what the median age of the pool is that the 30 year old would buy into. Most state and local government employee groups probably have a median age well above 40 even if you exclude eligible retirees who may be in a separate pool.

Finally, most large government employee health insurance plans are self-funded these days. So when an employee drops out because he or she is too sick to work or for any other reason, it’s the employer that escapes medical claims incurred by that employee, not the insurer. ASO business earns decent margins but the aggregate profit dollars are small especially compared to, say, the Medicare Advantage business.

Barry, you said, “So when an employee drops out because he or she is too sick to work or for any other reason, it’s the employer that escapes medical claims incurred by that employee.”

EXACTLY – So large employers escape the cost of the ovarian cancer employee who takes 4 years to die and self employed people have to now take them into their insurance pools and pay for big business so they can laugh all the way to the bank.

That is why Republicans say they want to repeal Obamacare but in reality they don’t. The Heritage Foundation and Jim DeMint want to keep Individual Health insurance paying the bill for Large Business and their employer-based insurance. You give me hope Barry.

Ron – According to recent data published by the Kaiser Family Foundation, the average cost of employer coverage, including the employee’s contribution, for single coverage is now $6,251 per year while family coverage costs over $17,000 even as high deductible plans proliferate. So, it doesn’t appear to me that employers are getting away with much from an insurance cost standpoint, except to the extent that they are shifting more of the premium cost to employees.

Prior to the passage of the ACA, my understanding is that that there were between four and five million people in the country that were considered uninsurable under traditional medical underwriting standards. This presumably would include your example of the woman with ovarian cancer. My answer to cover those people was adequately funded high risk pools but the per person cost of subsidies financed by a combination of general state revenue and surcharges on insurance policies was greater that most politicians were ever willing to vote for. Since in any given year, the sickest 1% of insured members account for 20% of medical claims and the sickest 5% account for 50% of claims, high risk pools would go a long way toward making health insurance considerably more affordable for the vast majority of people in decent health.

I’m not optimistic about politicians at either the state or federal level ever being willing to vote to spend the money that it would take to provide the uninsurable with decent coverage at a premium they can afford. In their eyes, it’s too much money to spend on too few people many of whom are too sick to even vote. That’s unfortunate.

Good comments as usual on the high risk pools.

James Capretta (a conservative) had a good piece on these pools in 2010. He estimated 2 to 4 million persons in the pools, and an annual cost of at least $20 billion.

As you say, politicians of both parties are afraid to approve this size of program.

The Democrats in general want to bury these expenses into guaranteed issue health insurance. This effectively taxes the other buyers in the individual market. Whereas if we used general revenue to fund these pools, then the expense would be born by richer taxpayers in general.

One random thought which comes to mind is that until about 1970, the old Blue Cross plans were largely guaranteed issue and community rated. But no one seemed to complain about high risk persons driving up the cost of the plans. I suppose that the invention of high cost (and largely effective) treatments for heart disease, cancer, etc has created a new group of expensive patients.

Not only are there large expenses to deal with medical crises that used to be fatal; in addition, the patient who now survives becomes an expensive chronic illness patient.

Bob, I started my career selling against those BXBS plans in the 70s. For larger employers we could offer experience rating, both prospective and retrospective, which resulted in lower costs. Insureds who are working were generally healthier than the community.

I think it was Rochester, NY where Kodak pulled out of the community pool causing rates to jump for individuals.

Having a single risk pool certainly avoids anti-selection, but there is also no competition by either insurer or provider.