Obamacare’s Second Open Season: Average Premium Up 23 Percent – After Subsidies

With enrollment data through February 22, the administration finally declared Obamacare’s second enrollment season closed and released its report on the results. (Although, people who have to pay Obamacare’s mandate/penalty/fine/tax as a result of information disclosed in their 2014 tax returns will have a special open enrollment in April).

Obamacare’s supporters cheered that enrollment hit 11.7 million people, exceeding the low-ball estimate of 9.1 million the administration made last November. Lost in the enthusiasm for Obamacare’s new high-water mark are a few uncomfortable facts.

First, the average premium — net of subsidies — has jumped 23 percent from 2014. In both years, insurers covering almost nine in ten Obamacare subscribers received subsidies to reduce premiums. The average monthly premium, before insurers receive subsidies, across all “metal” plans, is $364 in 2015. The average subsidy is $263, resulting in a net premium of $101 (Table 6). In 2014, the administration reported an average premium of $346, less an average tax credit of $264, for a net premium of $82 (Table 2). Therefore, the gross premium increased 5 percent but the subsidy declined by a scratch. Due to the power of leverage, this resulted in subscribers seeing an average premium jump of 23 percent.

Second, Obamacare continues to “churn” peoples’ insurance coverage. Like last year, we can expect a significant share of this year’s 11.7 million enrollees will never pay a premium, often because they will receive employer-based coverage if they move up in the world, or fall into Medicaid dependency if they drop.

For the states using healthcare.gov, only 4.2 million of the 8.8 million 2015 enrollees were enrolled at the end of 2014. After Obamacare’s first open season closed, the administration reported that 5.4 million of the 8.1 million enrollees had signed up through healthcare.gov (Table 1). (That figure was later revealed as somewhat contaminated by the inclusion of standalone dental plans.).

So, over one fifth of those who were enrolled by April 2014 had vanished from Obamacare by February 2015. Maybe some of them did re-enroll for 2015: Someone could have signed up in April 2014, dropped out during 2014 and signed up again this time around. This fragmentation of coverage in working and lower middle-class households is surely frustrating to them and harms the quality of care.

Third, a loss for the administration in the Supreme Court’s King vs. Burwell lawsuit will deal a mortal blow to Obamacare. This is the lawsuit asserting what the Administration is paying out of subsidies to insurers in state-based exchanges is illegal. Of the 11.7 million new enrollees, 8.8 million enrolled through healthcare.gov and only 2.8 million through state exchanges. The Supreme Court is expected to make a decision by July. If the administration loses, three quarters of Obamacare beneficiaries will be in states in which insurers lose their subsidies. To resolve the resulting inequity between states, Congress will have to respond with amendments to the Affordable Care Act that President Obama will sign.

Third, Obamacare subscribers are less satisfied with their plans than beneficiaries of other government or private health plans are:

The 29 percent of re-enrollees who switched plans is higher than that seen in other programs. For example, studies show approximately 13 percent of Medicare Part D enrollees change plans in a given year; 12 percent of those active employees with Federal Employee Health Benefit Plan coverage switch plans each year and only about 7.5 percent of those with employer sponsored coverage switch plans for reasons other than a job change during a given year. (p. 6)

Fourth, both the Obamacare subsidies and the Affordable Care Act’s big increase in Medicaid spending are higher than necessary to get people covered. Although the average net premium jumped 23 percent, subscribers were nevertheless willing to pay up for a higher level of coverage. While 77 percent of the 7.65 million subsidized subscribers who used healthcare.gov could have bought plans for less than $50, only 38 percent did. While 89 percent could have bought plans for less than $100, only 63 percent did (Table 7). Obamacare subscribers have enough discretionary income to pay for health insurance and need not be so dependent on taxpayers.

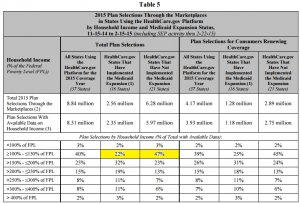

This is strikingly apparent among low-income households, which are eligible for Medicaid in states that chose to expand that type of welfare. (Medicaid is a joint state-federal welfare program that provides health coverage.) Table 5 (page 14) shows the income distribution of households enrolling in Obamacare, broken down into states that did or did not expand Medicaid.

Two cells are highlighted: Households between 100 percent and 150 percent of the Federal Poverty Level (FPL) in states that expanded Medicaid dependency, and those that did not. Many of the latter would be in Medicaid if their states had expanded the program. In such states, only 47 percent of Obamacare enrollees are within this income range, versus only 22 percent in states that expanded Medicaid. This indicates that Medicaid expansion has trapped people into complete government dependency for health care, who would be able to buy private health insurance with some government subsidy.

Despite a successful headline number of subscribers, Obamacare is still deeply flawed.

“Obamacare’s Second Open Season: Average Premium Up 23 Percent – After Subsidies…”

That’s why many insurers were not to keen to participate in the exchange; they knew the first year would be turbulent. The people who are in poor health were the most likely to sing up. The people in good health were the most likely to drop out. Some people may have enrolled because they needed care and then dropped out later.

A 23% hike in premiums will only exacerbate the adverse selection problem.

The gross premium increased increased 5 percent but the subsidy declined by a scratch

Due to the power of leverage this resulted in subscribers seeing an average premium

Jump of 23 percent

Can someone explain the power of leverage resulting in such a drastic increase of premium

While the net premium is still a bit over $100 per month this power of leverage if it continues will impact even the net premium

Don Levit

It is kind of like your government subsidiesd Fannie Mae/Freddie Mac mortgage: A decline in the value of your house is magnified as a hit to your equity!

1. What amount did the premiums increase relative to the AV of the plans. I suspect that not only did premiums go up, but a significant percentage of those changes plans move to a less valuable plan, and are paying more for less.

2. Does anyone believe that next years increase will be any less? With caps and controls on increases there is plenty of pent up need to increase premium even if 2015 turns out to be have better experience.

Short of King winning, Obamacare will ultimately end where most thought it would. It will provide mediocre coverage at high prices that will largely be born by the taxpayer. Which is what the Democrats wanted, other than those who want single payor.

HealthPocket has researched this. Deductibles increased significantly in 2014, not so much in 2015.

sorry Devon I have to disagree. The major companies who did not participate and still are not participating in the exchanges are more than likely the administrators of the state SCHIP plans…look at welmark or united health care in iowa as an example….neither company offers a plan on the exchange but they are the two companies parents can choose for there kids on SCHIP. With iowa expanding SCHIP elligbilty to 302% about 80% of the populations kids now qualify…. United and BC/BC are getting young health childeren sent to them from the exchanges without having to take on the old and unhealthy. Just makes God business for them to not take on the large risk of the adult population when you are getting the kids anyway….

I would not argue the conclusions of your article or most of the facts. But I feel the commenters and, perhaps others, do not really understand the interaction of a participant’s required contribution (their “cost”), the premium, and the amount of subsidy.

While premiums for exchange plans may have increased in an area, the “cost” to an individual participant is a percentage of their household income, so their cost only changes if the household income changes (within the 100% to 400% of poverty range — 138% on the low side in states where medicaid was expanded.)

So, if the “premium net of subsidies” increased, it did so because either (or both): The average income of participants retaining coverage increased, thus lowering the percentage of premium paid by the subsidy AND/OR the average income of the NEW participants in the Marketplace is higher than the average in 2014. (see below for a third cause)

While a 5% increase in premium would cause an increase in subsidies, it would not cause an increase in premium NET of subsidies. Primarily a change in the average income of participants would be the cause.

There is an additional factor that could increase the premium net of subsidies. In many areas of the country, only one or two insurance carriers offered coverage in 2014. In those areas, since the aforementioned fear of high claims, premiums were very high. Most of these carriers reduced their premiums for 2015. But, in many of these areas, new insurance carriers, seeing an opportunity, entered the market at much lower premiums. Here in Southwest Georgia (THE highest cost area of the US in 2014) the only carrier last year lowered their premiums by 8%, but another carrier entered the market nearly 20% below the new lower premiums of the incumbent carrier. Because the new carrier had much lower premiums, their plans were the “second lowest silver plan” and thus the basis of the subsidies — creating a substantial lowering of the subsidies and, if the individual (or family) retained the same plan from 2014, substantially increasing the premium due net of the subsidy. Our experience showed that many individuals retaining their 2014 plan had premiums net of subsidies increase from $20-$40 to over $200.

This unfortunate situation was exacerbated by a letter from the incumbent carrier (the letter and the wording required by CMS)that said “your 2014 premium was X, your 2015 premium will be “92% of x” and your 2014 subsidy is “95% of x” leaving you with a net premium of $0.” It did not mention that the 2015 subsidy was decreasing substantially, leaving the REAL net premium at about $200 per month. It was difficult to convince these individuals to change to a plan which, with the new subsidy, would have a net cost of maybe $30 or $40 — because the letter said they would owe no premium. Without a change, those individuals will have an increase in their tax liability for 2015 (due in April 2016) of over $2400.

So, contrary to the comments about carriers increasing premiums being the cause of the increase net of subsidy, the actual reason would be either an increase in income for participants or a new, lower premium plan lowering subsidies in a given market – both of which should be positive for those obtaining coverage — either they are earning more or they have the option of paying less – and relying less on subsidies.

I am NOT arguing that, in certain markets, premiums have not increased substantially, only that premium increases do not necessarily cause an increase in participant cost net of subsidy.

Thank you for your comment. I agree that an increase in household income among Obamacare subscribers would cause their subsidies to slip, relatively speaking. However, that still makes Obamacare a less attractive deal than otherwise, to subscribers.

Hi John,

The shell game of providing coverage to the uninsured has always been a diversion from the core problems with health care policy. Health care financing can only be fixed when health care economics are fixed, and health care economics cannot be fixed until pricing for health care goods and services is based on economic reality. My grandmother could offer health insurance, but neither she nor anyone else–including big health plans–know the true price of what they are paying for. While they may have negotiated prices, those prices are not relative to the cost of producing the goods or services, and as a result the prices vary wildly from payor to payor and even more wildly for individuals.

In short, it is time for health policy wonks to say with one voice that the emperor has no clothes. This country will never figure out a sound payment system for health care until it figures out a sound pricing system.

Cheers,

Charlie Bond

No questions, just an observation …

“Obamacare’s supporters cheered that enrollment hit 11.7 million people” [3.6% of Americans]

Hmmmmmm, let’s see …

Medicare subsidies and benefits are given to 52.3 Million.[16.3% of Americans]

Medicaid subsidies and benefits are given to 72.6 Million.[ 22.7% of Americans]

VA and Tri-Care subsidies and benefits are given to 12 Million. [3.7% of Americans]

Employers Ins. subsidies and benefits are given to 142 Million.[44.4% of Americans]

The uninsured receive the balance of the $1.35 Trillion that our Federal, State, and Local governments will spend on Health care in 2015

Worrying about the 3.6 % of Americans that are now off the uninsured rolls and receiving comparatively smaller amounts of subsidies than provided by these other programs, it seems that this blog is focused on the small potatoes.

We worry about Medicare. We worry about Medicaid. We worry about the VA. We worry about employer-based benefits.

And that is just on the payer side. We also worry about prescription drugs, medical devices, health information technology.

There is no end to our worrying.