ObamaCare Taxes Will Sock It to Low-Income Families

President Obama’s campaign promise:

Chris Conover comments:

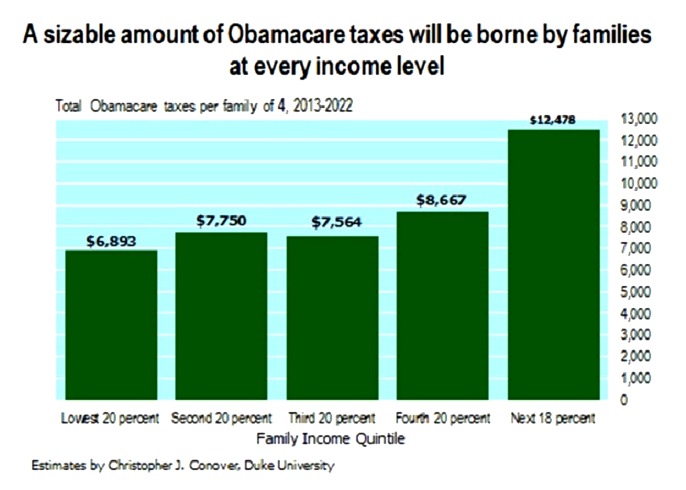

There’s 21 different taxes stuffed into ObamaCare designed to raise more than $1 trillion in taxes over the next decade. Last October I showed that only 30% of these taxes would actually be borne exclusively by “rich” households ($200,000+ for singles/$250,000+ for couples)…

Even the lowest income families (earning less than about $19,000 in 2012) will be on the hook for nearly $7,000 in ObamaCare taxes over the decade that started last year. [See the graph.]

Let’s be clear. ObamaCare also absolutely and positively is socking it to the “rich” (approximately the top 2%). I calculate that families in that income range will end up paying $177,000 over the same decade. But the much more surprising figure is that such families will end up bearing only 34% of the ObamaCare tax burden. It’s true that the top 20% of families will bear about 56% of the overall burden, but such families also account for 50% of after-tax income (at least according to the Consumer Expenditure Survey data I used to make my calculations).

So let the rich pay more money to feed the families with lower earnings?

I think that we must emphasize the fact that the President has lied in what he promised several times now. We cannot forget this. People criticize George W. Bush for enacting flawed public policies, some claim that he was the worse President because he couldn’t handle the critical events (this is open for debate, I believe that Bush lived devastating crises during his presidency, and he handle them as good as he could). But, Bush delivered what he promised. He promised lower taxes, he delivered. He promised more jobs, he delivered. People forget that Bush accomplished what he promised, unlike Obama who has spent his presidency promising but never delivering.

That is right. Whatever Bush promised, he delivered. Whether it was good or bad…

It is preoccupying the fact that people, who earn the same, perform the same job and have the same skills, are receiving different benefits due to the company they work for. It shouldn’t matter if a mechanic worked for GM or for Ol’ Pops Auto, if they perform the same task and earn the same, why is the employee of Ol’ Pops receiving more benefits. It doesn’t matter who is your employer if you are receiving the same check. If this is true big corporations will have a hard time finding new employees and will have to raise wages to remain competitive. This would eventually lead to higher prices and inflation. This differentiation is hurting our economy.

Low income families will pay ObamaCare taxes, high income families will pay ObamaCare taxes, all families will pay ObamaCare taxes. There is no way to avoid more taxes.

Of course Obama broke his campaign promises. It is par for the course for the way his second presidential term is progressing.

If you can depend on Obama to do one thing, it is that he will break some promises.

You have to break a few promises to make change.

I doubt this was the change that voters bought in to…

It must be hard being president and knowing that all your policies have failed. I think Obama has a hard time sleeping at night with the mess he created with the health industry. He has dug so deep that the only way out is to keep digging. He knows he has made a mistake, but he is committed and he knows that if he backs off it would be political suicide. Why do you think he has modified the law several times (and illegally in some instances)? He knows he messed up; he is trying to fix it without accepting that he was wrong. Poor Mr. Obama, his good intentions remained as such, as intentions.

The biggest burden imposed by Obamacare will be carried by those with the lowest income, and thus many would not get insurance. That is not what affordable means. Obamacare is a flawed policy that is leaving America worse off.

The persuasive power of the President, Obama has an unmatched skill with words. He can make anything sound nice and convincing. And that has made him successful. Regrettably he has used his power to confuse the people and trick them into supporting policies that aren’t in the people’s best interests.

I think that Dr Goodman is doing a bit of a rhetorical stretch in this article.

Here is my reasoning:

Let’s define a tax as a payment which I, personally, pay to the government.

If you go back to Chris Conover’s article in Forbes on 10-21-2013, he listed the taxes which he says are being borne by persons of modest incomes.

He included the Cadillac tax on policies, other taxes on insurers, mandate penalties to individuals, mandate penalties to corporations, drug and device taxes, and limits on FSA’s.

Other than the mandate penalties on individuals, none of the above come out of one’s income or require a check on April 15 to the IRS.

Now one can certainly argue that the indirect incidence of the taxes above will hit lower income persons.

Maybe indirect incidence is the same as a tax. I am not an economist so it could be.

But I would have preferred the more limited definition.