ObamaCare May be Doubling the Cost of Health Insurance. But It’s Hard to Verify That

Given that ObamaCare has fundamentally changed the nature of individual health insurance by forbidding companies to compete in the types of coverage they offer, how will we know if it increases coverage costs?

The Manhattan Institu te has published an interactive map entitled “ObamaCare: Know Your Rates” that it says “illustrates how the Affordable Care Act (aka ObamaCare) affects health insurance premiums for people who buy coverage on their own.” It says that rates have gone down by 37 percent in Colorado. People actually paying premiums in the Colorado individual market may find this hard to believe.

te has published an interactive map entitled “ObamaCare: Know Your Rates” that it says “illustrates how the Affordable Care Act (aka ObamaCare) affects health insurance premiums for people who buy coverage on their own.” It says that rates have gone down by 37 percent in Colorado. People actually paying premiums in the Colorado individual market may find this hard to believe.

Unfortunately, there seem to be some quirks in the way it measures rate changes.

This may be because its premium increase estimates are based on a composite rate that nobody actually pays. To find pre-ObamaCare rates, the Manhattan Institute went to the government website finder.healthcare.gov and recorded the five lowest “pre-ACA” insurance rates for each county for 27, 40, and 64 year-olds. The methodology section does not say when this was done. This matters because individual insurance rates started increasing shortly after ObamaCare was passed. Selecting rates close to its implementation date would miss significant parts of the rate increase, and bias cost estimate increases downwards.

Manhattan Institute researchers then adjusted the rates for the denials and surcharge rates reported for each policy on finder.healthcare.gov. It assumed that people paid three times more if they were denied. This is not necessarily the case in a state with a high risk pool and heavily subsidized premiums for uninsurable individuals with incomes under $50,000. This assumption would tend to raise the lowest premiums, narrowing the difference between them and any ObamaCare increase. After correcting the county premiums, the Manhattan Institute averaged them to get a statewide rate.

The map’s post-ObamaCare rates were obtained by looking at the base rates that insurers filed for offerings on the state health insurance exchanges, excluding catastrophic plans and plans that were only available in one rating area. This ignores what has happened to plan prices for a significant fraction of the market because many insurers decided to bypass the exchange. Others designed special plans that differ significantly from plans that individuals have historically purchased.

It also isn’t clear how the estimates account for the plan differences that make real comparisons difficult. In many states, the exchange plans have much more restricted networks than existing individual plans. Colorado is no exception. Of the 11 exchange plans, one has a network consisting of a single hospital and its 8 community clinics. Only two exchange plans are PPOs, and at least one of them requires permission to go out-of-network.

On September 17, 2013, the five least expensive policies listed on finder.healthcare.gov in the Denver area for a 27 year-old ranged from $73.54 to $98.72. The least and most expensive plans had no drug coverage. For $81.32 a month one could buy a Humana HMO plan with drug coverage and a $10,000 deductible.

Of the least expensive pre-ObamaCare plans, only one, the Humana HMO, is offered on the exchange. For a $6,300 out-of-pocket bronze post-ObamaCare policy the rate is $180.32 for a 27 year old living in Denver. The plan is offered in just two rating districts, Denver and Colorado Springs.

If the standard of comparison is simply the least expensive plans on finder.healthcare.gov without regard for what they cover or the date they are quoted for, ObamaCare has raised premiums by 122 percent using the HMO with drug coverage and a $10,000 deductible as the post-ObamaCare comparison.

If the standard of comparison is pre-ObamaCare policies currently shown on finder.healthcare.gov that match coverage and deductible, the same HMO plan is quoted at $163.97. Based on this, the exchange raises prices by about 9 percent. Of course the government website shows that no one has been denied this plan, so it is perfectly possible that this is a new offering and that no one has purchased it. How this would affect the calculation of the map’s composite rate is unknown.

There are other ways to look at what ObamaCare has done to health coverage costs. One would be to follow the cost of policies that have been grandfathered. In Colorado, one grandfathered HSA qualified PPO policy with a nationwide network and a $3,000 deductible for someone under 21 has increased from $144.28 in 2011 to $197.39 in 2013, a 37 percent increase.

Then there is the opinion of those who offer coverage. In its rate filings for the Colorado health exchange, Rocky Mountain Health Plans specifically stated that the cost of ObamaCare add-ons and taxes added about 10 percent to its gross premium index rate.

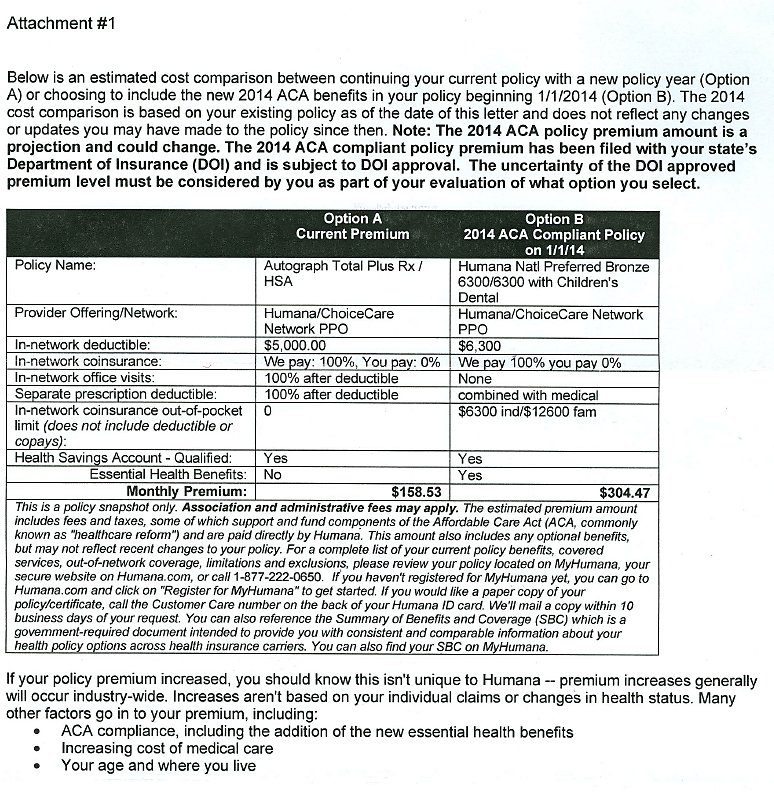

Finally, there are the notices that Humana Health plans sent to people who had non-grandfathered individual plans. An actual letter is reproduced below. Sent to a man in his early 30s, it projects that complying with ObamaCare will increase his individual premium from $158.63 a month to $304.47 a month, an increase of 92 percent. He is not happy that paying the higher premium also buys him a $1,300 increase in his out-of-pocket exposure.

People will be paying more for premiums and increasing out-of-pocket cost.

Meanwhile, businesses are cutting hours, small businesses are staying small due to the >50 employee insurance mandate, and “navigators” are stealing all of our private info.

This is what America asked for?

No, but this is what we are getting. The outrage is building as more and more information becomes known. But don’t be fooled, the left never intended ObamaCare to be a solution, the thing was designed to fail. Watch out for a push for single payer.

I think that you are right. The more a hear about ObamaCare, the more it looks like the thing was never meant to succeed. The left never wanted this, they always wanted single payer. They are banking on convincing the populace that Republicans screwed it up and more government is necessary to fix it. If history is any indication, they’ll probably succeed.

“This matters because individual insurance rates started increasing shortly after ObamaCare was passed.”

I would expect this to follow an exponential path.

I can support that opinion.

Adverse selection is looming on the radar screen. Young, healthy people would most likely save money buy not purchasing insurance, and old, sickly people are most certainly going to purchase this insurance.

For a time, yes, until it settles.

“Obamacare Will Increase Avg. Individual-Market Insurance Premiums By 99% For Men, 62% For Women” (Forbes)

http://healthblog.ncpathinktank.org/tag/health-care-costs/

Please note that the average you refer to includes a large decrease in some states. This post looks more closely at that result for Colorado.

If the Colorado estimate is off-base, what does it do to the published average?

Colorado rates are NOT going down; they are going up, and a lot up. Example – I got a quote from Anthem this last July, for a $7,500 deductible plan w/ 70% coverage for $370. On CO exchange website, similar Anthem plan but not as good, with $5,950 deductible and only 60% coverage = now $760/month. That = a 106% INCREASE!

It’s pretty simple to do the math here – When you (govt.) forces insurance companies to provide guarantee issue for everyone, no matter what their health condition is, and forces companies to remove all caps on coverage (if treatment comes to $20M they have to pay for it), there is nowhere for insurance costs to go but UP.

In Colo., we have a program that covers almost all costs for un-insured’s, and we also have a private program that offers insurance to those with serious conditions. Personally, I would like to see more of those type programs than this govt.-run crap.

That is amazing. Some people are helped by ObamaCare, but far, far more of us are hurt.

A $10,000 deductible!?

No thanks, I’ll take my chances at the local clinic or urgent care center.

High-deductible options are right for a lot of people, particularly the young, but being forced into it isn’t the right way.

This was the land of the free. I don’t like the power that the government is starting to demonstrate…

They’ve been doing stuff like this for at least a century. What should really worry you is how easily we all forget.

The private cost will rise, the public cost will rise, there will be long lines and poor service. Be prepared to utilize medical tourism services.

Dewaine, any suggestions as to where I can get the best “bang for my buck” for a back surgery?

India.

“People actually paying premiums in the Colorado individual market may find this hard to believe.”

I wonder how long the president and others can continue to insist this law is working, despite all evidence to the contrary.

I noticed that when I compared current health plans with ACA plans, the current plans were often more generous when comparing total cost for a catastropic illness. The old plans often had higher deductibles, but lower over all costs — and lower premiums.

href=http://www.offshorebillingcompany.net/insurance-verification-services/> insurance verification services today we have online tools for patient access reps that can help you to do your jobs effectively it will also help your billing department to finish work on timely manner.outsourcing insurance verification can reduce operating cost and company focus will increased on core business.

Lynda Altman loves animals and is ‘mom’ to three rescued dogs; Izzy, Sophie, and Romeo.

The new law allowed children to be covered under parents’ health plans until children

became 26. Consumers need to hold doctors financially accountable for their claim billing practices.

Here is my weblog … affordable care act sign up

When I went to the Colorado exchange website tonight (my 1st visit there), I noticed that so far anyway, there are only 2 companies offering insurance – Anthem and Cigna. And their premiums are sky-high, and the coverage is pretty crappy (only 60-70% coverage.)

Personally, when I had to get my own insurance and when I could afford to get it, I always got a high deductible w/ 100% coverage. Hospital stays are $20,000/day now, so I figured if I ended up w/ a $100K bill (not that uncommon), I’d be glad to pay $5K, with the insurance co. paying $195K.