Obamacare Health Plans Shun the Sick More in 2015 than 2014

A consistent theme of this blog is that Obamacare motivates health plans to shun the sick and attract the healthy. We often cite research from Avalere to support our case.

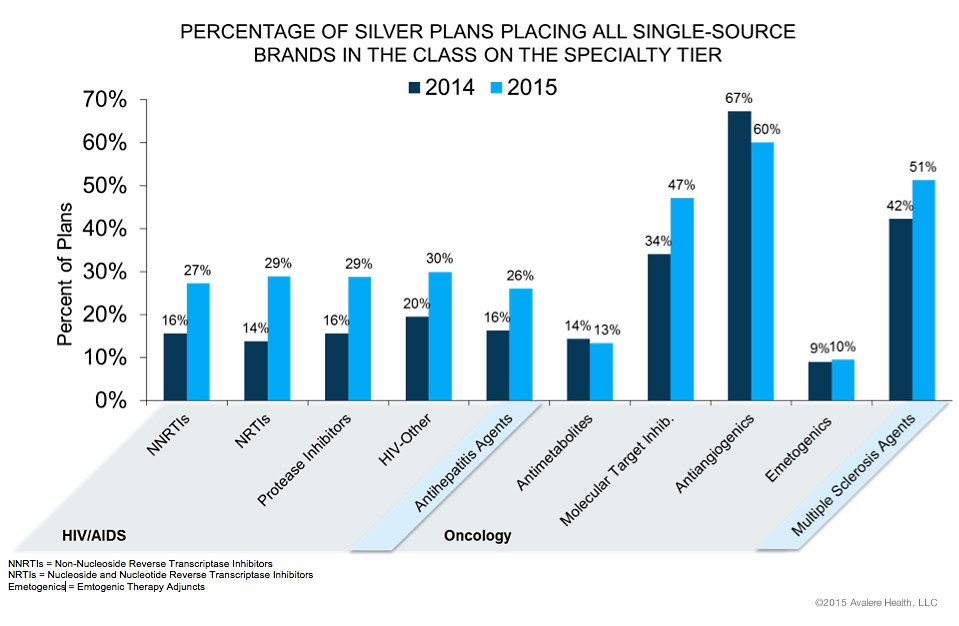

Avalere has done it again, with a study of how Obamacare plans place drugs for the most serious diseases, as HIV, cancer, and multiple sclerosis — on the highest drug formulary cost-sharing tier. Co-pays of 40 percent are not uncommon. And the situation is worse in 2015 than 2014. The bar chart below shows how many silver plans (the most common Obamacare plans) place all single-source drugs (that is, branded drugs without generic competition) in a therapeutic category on their most expensive tier. For eight of ten of these categories, a larger share of silver plans do so in 2015 than 2014. For example, 51 percent of silver plans put multiple sclerosis (MS) drugs on their most expensive tier. Last year, only 42 percent did.

The implication is that plans did not adequately succeed in attracting the healthy and shunning the sick as they had hoped. This is what we at NCPA expected. So, they have tightened up plan design even more.

This is a consequence of the heliocentric doctrine of health insurance, which we have condemned: Insurers want to enroll healthy people for one year, and are not very interesting in the long-term costs of treating sick people. This is backwards: The healthiest people should pay the greatest share of their own health spending, and the sickest the least.

Having insurance does not equal getting appropriate care. The ACA is about getting more people insured, that’s what the administration keeps touting. What they don’t tell you is all the hassles people are having getting to see their doctors, getting meds, etc. See this:

http://www.nytimes.com/2015/02/08/sunday-review/insured-but-not-covered.html?_r=0

Not a surprise. Insurance companies want to have the least expensive Bronze plan and the most expensive silver plan. This will help shield them from the sick and the over utilization of the shared assistance plans…I have been saying for years that insurance compies should employe there own call centers during open enrolment to actively switch the largest claim clients to there competitors products.

Just imangine someone with a prolonged illness facing tens of thousands in claims getting a call from there present insurance company informing them of there competitors plan during open enrolment.

Ask yourself why wouldn’t a company like Aetna try to actively switch it’s sick clients to united healthcare?

That just makes good business since…..

Actually, due to the biases in the risk adjustment methodology, the insurers will ultimately lose money on the healthy and make money on the sicker. So there incentive is to insure the less healthy.

Tell that to co opertunity or assurant health. One went bankrupt and one might.

The co-op obviously didn’t know what they were doing, an example of gov’t giving money away to novices. Has nothing to do with healthy vs. sick.

Hi Susan: Your comment was too brief for my understanding. Can you clarify how biases in the risk adjustment methodology will have this effect?

And to give a greatly oversimplified example to go with my comment above. Two insurers each sign up 10 people. Insurer A gets all the healthy people and Insurer B gets 10 people with condition X. People with Condition X are expected to be 3 times more expensive than the healthy people. The risk adjustment at end of year will require Insurer A to pay Insurer B. However, it is biased and will compensate Insurer B as if the condition is 4 times more expensive. So, anyone who says insurers want the healthy people is misinformed.

Let me guess your one of those PHD experts that operate in theory vs reality..

How you can come up with that kind of logic is amazing.

Under risk adjustment, eligible insurers are compared based on the average financial risk of their enrollees. The HHS methodology estimates financial risk using enrollee demographics and medical diagnoses. It then compares plans in each geographic area and market segment based on the average risk of their enrollees, in order to assess which plans will be charged and which will be issued payments.

Under HHS’s methodology, individual risk scores – based on each individual’s age, sex, and diagnoses – are assigned to each enrollee. Diagnoses are grouped into a Hierarchical Condition Category (HCC) and assigned a numeric value that represents the relative expenditures a plan is likely to incur for an enrollee with a given category of medical diagnosis.5 If an enrollee has multiple, unrelated diagnoses (such as prostate cancer and arthritis), both HCC values are used in calculating the individual risk score. Additionally, if an adult enrollee has certain combinations of illnesses (such as a severe illness and an opportunistic infection), an interaction factor is added to the person’s individual risk score. Finally, if the enrollee is receiving subsidies to reduce their cost-sharing, an induced utilization factor would be applied to account for induced demand.6

Once individual risk scores are calculated for all enrollees in the plan, these values are averaged across the plan to arrive at the plan’s average risk score. The average risk score, which is a weighted average of all enrollees’ individual risk scores, represents the plan’s predicted expenses (based on the demographics of enrollees). Under the HHS methodology, adjustments are made for a variety of factors, including actuarial value (i.e., the extent of patient cost-sharing in the plan), allowable rating variation, and geographic cost variation. Under risk adjustment, plans with a relatively low average risk score will make payments into the system, while plans with relatively high average risk scores will receive payments.

Transfers (both payments and charges) are calculated by comparing each plan’s average risk score to a baseline premium (the average premium in the state). Transfers are calculated at the geographic rating area, such that insurers offering coverage in multiple rating areas in a given state will have multiple transfer amounts that will be grouped into a single invoice. Transfers within a given state will net to zero. HHS proposes to use the same methodology in 2014 and 2015.

Data Collection & Privacy

Under the federal risk adjustment program, to protect consumer privacy and confidentiality, insurers are responsible for providing HHS with de-identified data, including enrollees’ individual risk scores. States are not required to use this model of data collection, but are required to only collect information reasonably necessary to operate the risk adjustment program and are prohibited from collecting personally identifiable information. Insurers may require providers and suppliers to submit the appropriate data needed for risk adjustment calculations.

To ensure accurate reporting, HHS proposes that insurers first validate their data through an independent audit and then submit the data to HHS for a second audit. For the first two benefit years (2014 and 2015) no adjustments to payments or charges will be made as HHS optimizes the data validation process. In 2016 and onward, if any errors are found through these audits, the insurer’s average actuarial risk will be adjusted, along with any payments or charges. Because the audit process is expected to take more than one year to complete, the first adjustments to payments (for the 2016 benefit year) will be issued in 2018

Thank you big ham. I would add that Susan’s argument is contradicted by insurers’ behavior. If insurers were motivated to attract the sick, they would not advertise with healthy models. They would advertise with photos of cancer patients lying in bed.

Hi John: I assume that you are joking. Healthy models send the message that an insurance company keeps you healthy.

You opine that the healthiest people should pay the greatest share of their own health care costs. If our society had unlimited resources, your opinion would have more merit. Speaking for the fiscally conservative (my guess at the consensus opinion of such group), I have concerns that the greater the health care subsidies, the greater the “abuse”. By abuse, I mean (1) out-right fraud; (2)over-use by those who are quite convinced that the medical industry is supposed to keep them healthy regardless of their life-styles; (3) extremely defensive medicine. Your position is the most admirable from a philosophical standpoint; I am not at all sure it is the most practical in a world with limited resources. My school-mate Karl believed that a society should take “from each according to his ability” and give “to each according to his need”. But he foresaw a society in which there was enough to satisfy everyone’s needs. And, he did not count on someone like me who can characterize luxuries as needs.

Insurance companies keep you healthy? Does a health insurer stop you from having a heart attack, or cancer, or being hit by a bus?

Does a fire insurance policy stop your house from burning down? Does your car insurance policy stop you from crashing? Does your life insurance policy stop you from dying?