New Harris/HealthDay Poll Finds Americans are Fickle; Uninformed.

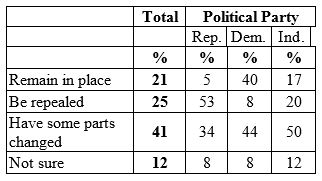

A New Harris / HealthDay Poll came out that finds many Americans do not really understand how insurance works. Ok, what it officially found is rising support for the Affordable Care Act. About 41% want to improve the Affordable Care Act (ACA) rather than replace it. One-quarter (25%) want to repeal the ACA, while 21% want to leave it “as is”.

A New Harris / HealthDay Poll came out that finds many Americans do not really understand how insurance works. Ok, what it officially found is rising support for the Affordable Care Act. About 41% want to improve the Affordable Care Act (ACA) rather than replace it. One-quarter (25%) want to repeal the ACA, while 21% want to leave it “as is”.

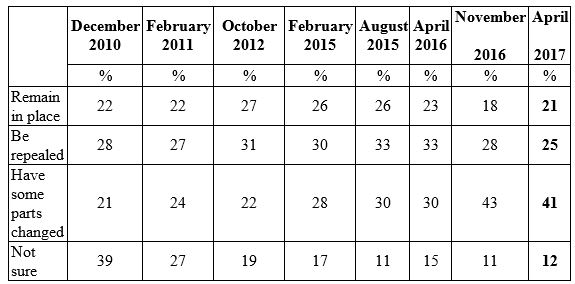

One surprising finding is that people have stronger opinions now than back in 2010. The percentage who are unsure has fallen (39% in 2010 and 12% in 2017), while the proportion who believe Obamacare needs improve has risen (21% in 2010 and 41% in 2017).

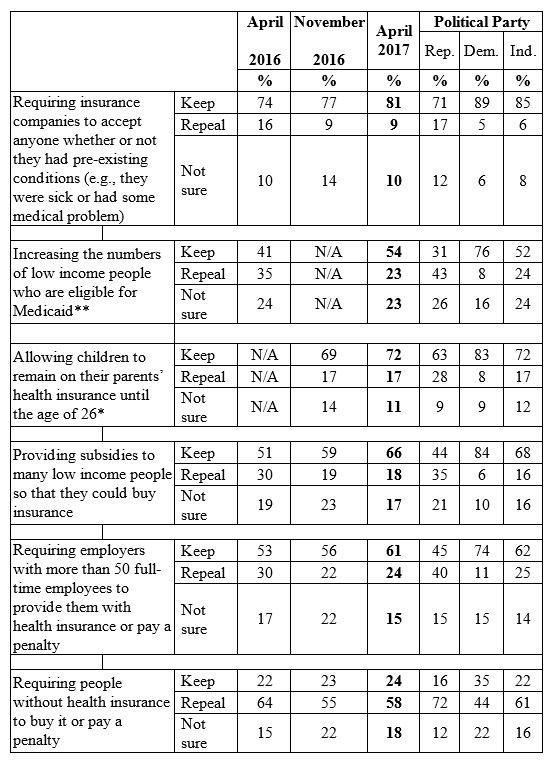

It also finds Americans are a fickle bunch. Only about one-quarter (24%) favor keeping the individual mandate, while 58% want to repeal the mandate. Of course, the individual mandate is necessary to stabilizing the risk pool. No insurer can withstand people who enroll when sick and then bail out when healthy. The individual mandate is (at least in theory) what forces healthy Americans to over-pay so sick Americans get coverage that’s a better deal.

It also finds Americans are a fickle bunch. Only about one-quarter (24%) favor keeping the individual mandate, while 58% want to repeal the mandate. Of course, the individual mandate is necessary to stabilizing the risk pool. No insurer can withstand people who enroll when sick and then bail out when healthy. The individual mandate is (at least in theory) what forces healthy Americans to over-pay so sick Americans get coverage that’s a better deal.

About two-thirds (66%) want to keep key provisions. For instance:

- 81% support requiring insurers to cover people with pre-existing conditions;

- 54% favor expanding Medicaid;

- Two-thirds (66%) support subsidies for many low income people;

- 61% support the employer mandate;

- 72% support allowing children to remain on their parents’ health insurance until age 26.

More Republicans are unsure of repealing than in the past. Some fear about repealing Obamacare is probably fear of the unknown. People want to know what replaces the ACA before committing to repealing it.

The public wants to keep costly provisions because they don’t realize those are what is driving up premiums. In addition, people can be rather generous when they believe someone else is paying the bill. Many people likely want other folks to have access to guaranteed access to policies that cannot discriminate against pre-existing conditions but they themselves want more flexible policies that are cheaper.

There are 2 big problems with this FAKE polling.

1. These are the numbers after mass brainwashing by the media.

2. These are the wrong questions.

I suggest these questions.

1. Should the American Cancer Society be able to terminate the insurance on their own employee if they get ovarian cancer and get too sick to work?

2. Does the American Cancer Society support Obamacare because they want their own bald headed cancerous employees to be able to get insurance after their employer-based insurance has been terminated?

[answers are the easy part – the questions raise the doubt]

I got problems with my brain underneath my curls

Problems with Lorain and all the other girls

Love a wealthy woman and the pretty plane she flys

If you think this sounds confusing you should see it through my eyes

Dancing, dancing, dancing through my eyes

Well I’m turning off the waterfall the tourists can go home

I feel it TIME to travel take TIME to write a poem

TIME to seek some therapy I’m going walkabout

[The answers are the easy part the questions raise the doubt]

https://www.youtube.com/watch?v=wV7Hqj5oq78

NewsFlasH: TrumpCare passes in a landslide 217 – 205

How can this be with only 17% polling support?

Now all eyes on the Senate. My Senator Bill Nelson (D-FL) cast the deciding vote that plunged America into the dungeon of despair with Obamacare. Now he and 17 other Democrat Senators are up for reelection in 2018. Will he continue to ride the Obamacare dead horse into the ground or WAKE UP and vote for TrumpCare and Make America Great Again (MAGA) and try and keep his job?

TIME will tell. –I want to be ELECTED!–

https://www.youtube.com/watch?v=1i4EnjRKVQw

Employer Sponsored Insurance (ESI) has an unfair advantage. Our current health insurance system is divided into 5 major groups with annual tax payer’s subsidies. Medicare $527 Billion, Medicaid $552 Billion, Veterans $187 billion, Employer sponsored Insurance (ESI) $380 Billion and the individual markets $110 Billion.

ESI it the most profitable market for insurance companies. ESI is the only market that the insurance companies can use eligibility clauses to get rid of the sickest patients. These include having to work a set number of hours per week in order to qualify for coverage. So if you get so sick you can no longer work you lose the coverage. The insurance companies also use participation requirements. The insurance companies mandate a certain number of employees at each company must purchase insurance in order for the group to qualify. Typically this is around 70% of the eligible work force. The insurance companies also use claims experience to set the rates of the group. In effect pricing the cost of the insurance at a level high enough to insure the insurance company makes a profit.

The individual market although extremely small compared to the ESI market was profitable for the insurance companies before the passage of the ACA. Eliminating the ability for the Individual market to control its cost the way ESI control its costs has caused the individual market to collapse. Some would argue all the ACA did was to create a perfect dumping ground for ESI to get rid of the sickest employees.

Why do the U.S. have 5 separate health care groups and why does one of those groups have a significant advantage over the other 4 in controlling its costs?

Of course if you divide the subsidies for the five groups by the number of covered individuals in each group, the comparison looks a bit different.

I’d like to see conditions improved for the individual markets so that there’ll be an actual viable alternative to ESI that people would consider attractive. Why buy an individual plan on an exchange when (1) the net price is well above your actuarial cost and (2) you have no assurance the coverage will be available from one year to the next.