Medicare’s Spending per Beneficiary Increased Twice as Fast as Employer-Based Plans’ in Ten Years

A new study from the American Health Policy Institute analyzes the growth in health spending by different payers over the last decade. In summary, the study found:

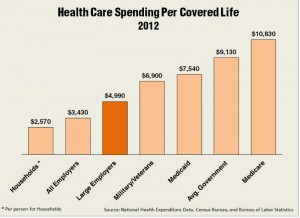

On average, all U.S. employers spent $3,430 per covered life on health care in 2012, up 13.6 percent from 2003 after adjusting for inflation.

On average, all U.S. employers spent $3,430 per covered life on health care in 2012, up 13.6 percent from 2003 after adjusting for inflation.- On average, large U.S. employers (1,000 or more employees) spent $4,990 per covered life on health care in 2013.

- In 2012, government (federal and state) spent $1.1 trillion on health care, or an average $9,130 per covered life, up from $8,010 in 2003, or 14.0 percent, after adjusting for inflation;

- Government spent over $6,900 per covered life on health care for military and veterans health programs in 2012, up 10.6 percent from 2003 after adjusting for inflation;

- Medicaid spent almost $7,540 per covered life in 2012, down 2.8 percent from 2003 after adjusting for inflation;

- Medicare spent $10,830 per covered life in 2012, up 28.2 percent from 2003 after adjusting for inflation;

- The average cost of government health care spending per covered life has risen almost 30 percent since 1995 after adjusting for inflation, from $7,040 to $9,130; and

- Households spent an additional $2,570 per person on health care, up 11.6 percent from 2003 after adjusting for inflation.

“In 2012, government (federal and state) spent $1.1 trillion on health care, or an average $9,130 per covered life, up from $8,010 in 2003, or 14.0 percent, after adjusting for inflation;”

Just imagine how much it will be for 2014 after ObamaCare and Medicaid Expansion. Government spending on health care will be on a whole new level.

“If you don’t have your health, what do you have?”

I think this is the justification of rising health care costs in this country. Everyone is going to go bankrupt trying to manage health coverage.

These increases are only going up through 2012. What will the next few years will look like? Spending per life through the exchanges and Medicaid will skyrocket.

Especially Medicaid. With one out of five being covered by expanded Medicaid, Medicare and Medicaid spending will continue to rise for awhile.

It is interesting to see how much health spending is increasing when adjusting for inflation.

Interesting or frightening.. Either of those.

I’d say a little of both. But with an aging population and medical costs as high as they are, it’s easy to see how so much is spent on Medicare spending.

The primary difference between employer health plans and Medicare (besides higher health costs for older enrollees) is that employers have experimented with higher cost-sharing. Over the past 10 years, cost sharing in the form of deductibles has about doubled. Other forms of cost-sharing incentives have also taken hold. Nearly 30 million people have either HSAs or HRAs now. This is not the case with Medicare.

“On average, all U.S. employers spent $3,430 per covered life on health care in 2012, up 13.6 percent from 2003 after adjusting for inflation”

This is about 1.4% per year. I would not be surprised if that’s because the employee base is now older on average and thus more costly. The employee base could well be older today because of the drop in the employment rate especially since 2008. Just my guess.

Keep in mind that one result of employers’ success in holding down their medical cost increases is that more costs are shifted to employees. If something significant had happened to restrain the growth in per capita medical costs that shift would be lower or nonexistent. But that something did not happen.

Of course the kicker is “after adjusting for inflation”. The unadjusted change over that 9-year period was surely much more than 13.6%. Whatever the unadjusted (%) was, you can be sure it affected both wages and prices.

I appreciate the article, but it is totally bogus. Insurance is NOT health care, and Obamacare, being nothing more than insurance, is NOT health care either. What you pay to participate in Obamacare is much more than you would pay for health care.

Of every dollar spent on healthcare insurance, less than $0.80 goes to health care itself; the rest goes to insurance company profits and expenses, including those of marketing, administration and lawyering.

I can pay Subway $5 for a sandwich and another joint $8 for the same sandwich delivered. The second sandwich did NOT cost $8. It cost $5 and the delivery cost $3.

The Amish don’t participate in Obamacare, but they do pay for health care, and they get it without paying for the “delivery.” Fools are those who pay others to do for them what they can do cheaper for themselves or forgo entirely–things like invasion of your privacy, limitation of your provider network, paperwork, time wasted for justification of expenditures, etc.

Insurance is always and everywhere a total crock. If it weren’t, we’d all carry sandwich insurance and sex insurance.

“Insurance is always and everywhere a total crock.”

I take it that Jumbino is one of the brave uninsured — or maybe Amish.

It also appears that Jumbino has not yet experienced a $225,000 Subway sandwich. Let’s all hope he or she as the case may be, never does.

Regarding the old canard of the “$225,000 Subway Sandwich”: No rational person bases his designs, much less his life’s program, on outliers. If he did, no plane and no house would ever be designed that could function. Planes would be built like tanks and houses like fortresses.

We who understand STEM well know that, but healthcare consumers like Fenbup swallow the line that you need insurance to cover the worst eventuality. Not so: even mandatory auto liability insurance has a coverage cap of some $60,000—far below the losses in many serious accidents.

One thing we do know is that an uninsured person who has a certain probability of having to cover a $60,000 loss comes out far better than if he were insured, paying some $100,000 in premiums to cover the same loss.

That’s how insurance works, and that’s why the Amish and I do much better, on average, than the person like Fenbup who swallows the insurance line.

But of course Obamacare isn’t insurance. It’s worse. It’s more like an expensive and cost-shifting pre-pay plan for health care that pays for exams, contraceptives, inoculations and all sorts of other non-catastrophic things.

Imagine paying monthly premiums for food “insurance.” Instead of your current $600 per month family food expenditures, you’d be paying monthly premiums of $1000 on average, with the poor getting free food and the better-off paying $2000 in monthly premiums for the same food.

“an uninsured person who has a certain probability of having to cover a $60,000 loss”

Jimbino, the problem with your reasoning is that there is no “average person”. On average Americans have one testicle and one ovary; how many such average Americans do you know? Physicians know this – “average” has no clinical meaning.

You are instead talking about probabilities over a large group of people. Those probabilities are correct – the incidence of serious medical problems across the American population is still relatively low. However, an individual – you, for instance – will either have a serious and potentially bankrupting medical problem – or not. Individuals take on great financial risk when they ignore this fact on the basis of some fictional “average” person.

Jumbino again I congratulate you on being one of the brave uninsured (or maybe Amish).

And again I say it appears you have not yet experienced a $225,000 Subway sandwich. I hope you never do.

I wish you well.

Specious argument, Fenbup. Yes, the “average person” can and will be designed for. That’s why kids and small adults need to disable the air-bag, why airplane seats have a certain pitch. If we designed for the outliers, we wouldn’t have airbags at all and the airplane seats would all have to be spaced for the comfort of a 6ft-6in, 300-lb football player.

The average hospital bed is 80″ in length and the average patient in it is getting a return of far less than 80 cents on his healthcare premium dollar.

So you say insurance is always a bad deal. Maybe that’s because you insist on viewing it as a form of investment (“getting a return”) rather than what it is – financial protection against a significant unforeseen event. Whatever.

I still hope you never encounter that $225,000 medical expense because that will be hard for you to pay, being uninsured and all.

There are many things you are not aware of, Fembup. Among them are:

1. Absence of an annual cap and a lifetime cap on co-pays has been normal, and is continued under Obamacare until at least 2015:

http://www.nytimes.com/2013/08/13/us/a-limit-on-consumer-costs-is-delayed-in-health-care-law.html?smid=tw-nytimeshealth&seid=auto&_r=0&pagewanted=all

2. A huge percentage of bankruptcies caused by medical expenses are suffered by the “fully insured.” While it used to be that medical expenses drove people into bankruptcy, we can no expect outrageous Obamacare premiums to do so.

3. “Expected return” is not an exclusive feature of investment analysis, but is what all economists use to evaluate policies in general and what all mathematicians use in game theory analysis. Have you ever heard of the “expected return” of a bet on Black in Roulette–also not an investment?

I forgive you your deficiencies if your interests and education happen to be limited to History, English, Poly Sci, and International Studies as is the case for our Supreme Court.

“I forgive you your deficiencies ”

I’m so grateful.

“Absence of an annual cap and a lifetime cap on co-pays has been normal, and is continued under Obamacare until at least 2015.”

Bzzzzzzzzzzzzzzzt. PLENTY of policies HAD annual and lifetime caps until ACA made them non-compliant. Now people won’t have fake insurance. And this requirement does not expire after 2015.

If you apply investment return as your only criterion as to whether to buy insurance, then you would never buy ANY insurance. Insurance is not an investment and a policyholder’s “expected return” is ALWAYS negative for insurance.

My point exactly. Insurance, like religion, finds no justification in reason or prudent behavior.

First the statistics that are presented. They do not include the average age of the reported population. You only qualify for Medicare if you are at least 65 or very disabled versus the general population. Once this is understood, the results reported are clearer.

The Amish system works because of the strength and cooperation among the members of their communities, their much healthier than average eating habits, the exercise they get from hard work and their being very financially responsible.

While I am not Amish I do strive to follow their examples. I exercise daily, I eat well, I take no prescription medication and I have saved 15% of what I earn for a long time.

The purpose of insurance is to protect against an uncertain event. You do not insure a certainty, you budget and or save for the eventual expense. 6 years ago with my wife and I at age 58, and having raised 3 children, we would have been better serviced saving and paying our own medical expenses, at 64, and 4 knee surgeries, rotor cuff repair and a hip replacement, we are closer to breakeven and I anticipate costs over the next 7200 days of my life, we will receive in benefits all that we deposited in insurance and Medicare premiums and maybe a little more. So in reflection I did not need insurance. I could have saved and had my earnings remaining. The loss of the use of money, provided the protection. The problem is I could not guarantee this result, so I chose to set aside 5% of my income as insurance premiums to protect against the uncertainty.

A major issue is that medical technology has advanced faster than our social intelligence. We can sustain life beyond quality. We are all going to die. We need a healthy workforce to be a productive society. We need to develop procedures for the effective delivery of health care and policies on what is society’s responsibility and what is individual responsibility and tools for people to use to plan in a fashion that meets their philosophy, budget and timeline.

With a Master of Sciences in Metallurgical Engineer I understand and have taught STEM courses and with 40 years experience as a business owner helping our clients design and service their employee benefits packages we all have to understand that within our lifetimes you cannot consume more than you create and we need to educate and encourage people to plan accordingly. Bill

Thank you but Medicare has always been for people 65 and over. (I am ignoring renal failure.) So that has not changed over the period. In fact, if anything, because the baby boomers started coming into Medicare a couple of years ago, they lowered the average Medicare age. (That is, a “bulge” came in at age 65.) So, there should be a downward trend in Medicare spending because of that.

You praise the Amish. Fine, but there is no reason to expect that they have a corner on prudence or healthy living. And having “strength and cooperation among … members” is something La Costa Nostra and many gangs have. Should the Mafia and Hell’s Angels also get a pass on the Obamacare mandate?

You say, “The purpose of insurance is to protect against an uncertain event.” I say it is to convince hoi polloi to pay a premium for false security.

You could buy food insurance or sex insurance. Why don’t you?

In Blackjack, you are offered the opportunity to buy “insurance” as well. Any game theorist worth his salt will analyze the advisability of such based on considerations of “expected return” or “expected outcome.” The expected return on the Obamacare premium dollar is worse than the return on Roulette, Blackjack, Blackjack “insurance” or almost any other casino game. Probably even worse than the return on the State Lottery.

Of course, playing those games can be fun. It can’t be fun writing checks to Obamacare or any other insurance scam.