How Much Should We Subsidize Retirement?

A version of this post originally appeared at Forbes.

Our federal deficit problem is an entitlement problem. And our entitlement problem is mainly about income and health care for the elderly. As I pointed out in a previous post, entitlements for the elderly mainly subsidize retirement. If we cut back on spending, seniors will have less retirement income unless they work more and save more to replace those retrenchments.

How much should we cut back and how should we do it?

Take this job and shove it.

I ain’t working here no more.

One frequently mentioned proposal is to raise the age of eligibility — which is inching up to age 67 for normal Social Security benefits and age 65 for Medicare. Increased life expectancy is allowing seniors to collect more benefits than was originally intended, it is argued. So we need to raise the eligibility age to keep the system solvent. Since 1970, for example, life expectancy at birth has increased seven years. To keep Social Security and Medicare affordable, therefore, should we consider increasing the age of eligibility by seven years?

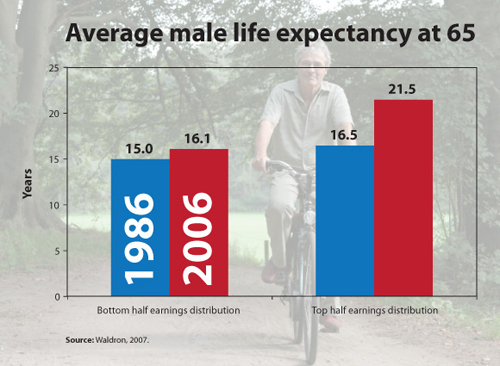

New York Times columnist Paul Krugman calls such proposals “cruel,” arguing that the life expectancy gains at age 65 are mainly the gains of the top half of the income distribution. (See the chart.) Krugman writes:

[A]ny further rise in the retirement age would be a harsh blow to Americans in the bottom half of the income distribution, who aren’t living much longer, and who, in many cases, have jobs requiring physical effort that’s difficult even for healthy seniors. And these are precisely the people who depend most on Social Security. [See the following graphic.]

Source: Economic Policy Institute

Another study of income and life expectancy was produced by Thomas Saving and his colleagues for my own National Center for Policy Analysis. This one used county data and it found that life expectancy generally rises as lifetime income rises. In other words, the more you earn, the longer you live, although the relationship is far from perfect. Again, the inference is that a higher retirement age, as the sole strategy in reforming Social Security, hurts lower income retirees the most.

Then there is our post the other day, based on a Health Affairs study, showing that life expectancy has actually been going down for high school dropouts.

But wait a minute. The real problem here is that not everyone can expect to live to the same age. And income isn’t the only thing that matters. Take race and sex, for example. A white male today has a life expectancy at birth that is five years longer than a black male. A white female at birth has a life expectancy of about 10 years longer than a black male. Raising the retirement age would take proportionately more benefits away from blacks than whites and from men than women.

Life expectancy also differs by location. According to one study:

[T]he range of life expectancy at birth for the years 1999-2001 extended from 72.3 for the District of Columbia (lowest) and 73.6 for Mississippi (second lowest) to 79.0 for Minnesota (second highest) and 79.7 for Hawaii (highest). Life expectancy at age 50 for the same years reflected a similar hierarchy: from 28.0 for both the District of Columbia and Mississippi to 31.4 for Minnesota and 32.4 for Hawaii.

The disparities are even greater at the county level, where life expectancy at birth for women who live in the top county is 13 years longer than for women who live in the county at the bottom. Among males, life expectancy at the county level differs by 18 years!

Saving and his colleagues point out that if our chief concern is over the progressivity of benefits there is another way to go about reform: raise the eligibility age and at the same time change the benefit formula to offset the regressive effects of the age change. This saves the government money while maintaining the current progressivity of Social Security.

But there is something else to consider. Why do differences in life expectancy exist? Surely part of the reason is the choice of lifestyles. Some people live healthier lives than other. If we want to encourage healthier living (and just about everybody seems to want to do that) doesn’t it make sense to allow people who live healthier lives to reap the economic rewards of doing so?

Any eligibility age arbitrarily favors some groups over others. But why do we all have to have the same age of retirement? In Chile people can choose their own retirement age. Chileans save in private accounts and when they have saved enough to provide a minimum retirement income, they can purchase a retirement income annuity — at any age! Plus they can keep right on working while they receive their annuity.

Had we been wise enough to follow Chile’s example, we wouldn’t be having this debate.

I’ve said it before, and I’ll say it again – set the increases in age eligibility to the increases in life expectancy, adjusted for race and sex.

I like the music pairing.

To me, it seems reasonable to increase the life expectancy and adjust certain factors that influence life expectancy for certain demographics. However, I am inclined to like the Chilean model as I have lived there for a year and I did not seem to encounter a whole lot of contention toward this retirement model as opposed to other public policy issues being contended in the country. We need to be a more pro-active country because the current gridlock and polarization in this country is contribution its eventual demise.

I am liking your recent postings.

Another thoughtful and well done piece.

Reform of entitlements also needs to carefully separate out the true social insurance aspect (buying an actuarially fair product that provides me an indexed pension for as long as I live) from the quite separate issue of welfare/charity transfers to those who have saved too little.

The latter issue needs to be separately handled by entitlement reform that directs or targets charity/welfare aid narrowly only to those who need it and it should be given in the form of cash grants that can then be spent as the recipient chooses.

The government should not be imposing one retirement age on everybody. With personal accounts, each worker can choose the retirement age suitable for them. I work at my computer all day at home (and all night). My retirement plan is to keep working until I become disabled. I think I can keep going at what I am doing at least until 79. That works for me too because I would do what I do for free if I didn’t need the money. There are millions of others who would live longer and more prosperously if they didn’t retire until 75 or so, for similar reasons to mine. But other people can’t keep doing what they are trained to do much past 60. So they and their employers need to save more during working years so they can retire earlier. With personal accounts, we can have wide ranges of retirement ages chosen by the workers individually themselves. That is the only sensible solution. The rest of you should focus on setting your own retirement age, and leave the rest of us alone.

Old age supplemental income is something people should be encouraged or coerced into planning for. However, it’s hardly the responsibility of government to fund 30 years of retirement so people can spend their Golden Years playing golf, traveling or lounging around the house.

Excellent and practical suggestions to fix a broken system until you went off track to the Chilean model. Likewise, your other readers’ suggestions regarding personal savings accounts are distracting. As a people, we need to make changes to our current system. Changing to an alternative is not going to happen, and it is wasted energy to wish for that. At this point, we need your group and other bright minds to devote 100% of their efforts to solving an immediate problem with our current system. Dreaming of Chile and personal savings are diversions which we cannot afford.

Tom Newsome

Why not means test based on ability to pay?

This isn’t new stuff.. The height economics is still a topic that regularly receives attention from serious scholars.

The Chilean solution is the best. Get Government completely out of controlling private lives. Let us not judge who has good habits and who has bad habits. Let there be private local trusts to help the destitute. They should , just like current non-profit social services provide the help for the destitute. Only problem with the current social services workers are not trained enough , nor have the ownership in the task. If active non-profits can develop proper local guidelines, this will be the best solution for people who really have no other way. If there are enough localities do things with right processes, others will follow.

There is so much desire from us to control other peoples lives. Even parents need to see where they are really helping, and where they are not listening to their kids.

Our federal Government became the most ignorant , arrogant and obstinate parent.

It is time to fix this parent.

Is it just me, or does anyone else have a problem with the term “entitlement”? Who pays for Social Security, after all. People who draw it when they retire. This isn’t a handout people, it’s money that we all invest via the social security tax, into our own retirements. By law it is supposed to be kept in a trust, not touched for anything else, and then disbursed when it’s needed. Medicare is the same way, from what I understand. To my thinking, this is not the “government’s money”. It’s our money, held in trust for us by our government. My late husband paid into social security for forty years, but died long before he was eligible to collect any. I would think this happens a lot, which leads to money not being paid out. What’s the problem, and how does breaking this trust save the government money?

Jennie:

The excess FICA contributions were not kept in trust.

They were loaned to the Treasury to pay for current expenses.

All that remains in the trust fund is simply numbers, for all the cash has been stripped. These numbers represent draws on the Treasury’s general fund, the same way we pay for all expenses. The trust fund is pay-as-you-go, like Medicaid.

The only difference is an implicit promise to pay back the trust fund, known as intragovernmental debt.

It is the lowest of 4 categories of debt, representing government’s willingness and ability to repay.

Do you think that was what FDR intended for Social Security to evolve into?

Don Levit

A portion of Social Security benefits can be considered “return on investment”, but only up to the point that past contributions were sufficient to justify the payout. The remainder is basically largesse used to buy votes.

Raising future taxes (or even retirement ages) to make up for inadequate past revenues is fundamentally unfair, since future retirees are being forced to make good for those who were undercharged. In that sense, a clawback is the most fair means of recovery (but neither compassionate nor practicable), followed by benefit reductions, benefit freeze, and then possibly delayed eligibility and finally increased future taxes.

Means-tested retirement benefits aren’t really justified, but the system already has a means-tested/general fund financed component. It’s called SSI.

Perhaps we could ramp down projected spending for regualar Social Security in order to make it actuarially sound, and increase SSI eligibility and benefits to meet whatever level of compassion the country can afford.

Interestingly blue collar workers die younger when the retire earlier. It seems that because retirement allows for time for drinking. Now we classical liberals do not have a problem with that but progressives seem obsessed with increase life expectancy even to the point banning large beverages servings.

Social Security is a welfare program that is disguised as a Ponzi scheme to make it palatable to voters. The disguise is getting too expensive we need to welfarize SS. Raise the age of eligabilty to 70 for the healthy make it you can get it early due to poor health, roll the FICA tax into the income tax and give everyone the same minimal benefit in retirement say $700/month. Done.

What happens to the statistics if the “non medical” causes of death in the early years are eliminated? I suspect the numbers get much closer – particularly the black males.

Partly pyramid scheme, partly tontine, and partly a way to extract money from heirs of the short-lived in order to finance an extended retirement for the long-lived.

Mr. Newsome sorry but a Chilien model is exactly what needs to be employed. And it can run side by side with SS as a choice each indivigual can make. As for the age differences poor die earlyer woman live longer then men. What role does life style play in these statisticts?? If you are a working class person with good lifestyle choices to include exersise, good food choices, weight control, low to no drug or alcohol use. I can not imagine why the life expectancy would be different? And I am sure that it is not. So please stopo with this progressive crap on woo are the poor. Take personal responsibility for your life style choices and then it all boils down to the luck of genetics.

Medicare and Social Security: not entitlements, but, as one woman poster wrote about a year ago (on this site?), they are EARNED BENEFITS.

Medicare is a lousy benefit. It only guarantees that as a senior you may (MUST, actually) buy insurance through the govt plan. So now we are paying about $120/month for an individual policy…which does not cover dental, hearing, nor vision (except cataracts and glaucoma). And the monthly fee is set to go to $247/month in 2014. It further is lousy in that it pays doctors so little that at least 30% will not see any Medicare patients.

Medicare needs a competing PRIVATE plan…and have the govt contribute its share to the private plan if a patient so chooses.

BTW, I paid into Medicare for 40 years before I first entered the plan…Imagine, you younger people, if you had to contribute to your insurance coverage, say Anthem Blue Cross or United Healthcare, for 40 years before you were covered.

I would indeed raise the age to 72.

Note that Obama’s new Medicare tax in Obamacare/Abysmalcare does NOT go into Medicare, but into a general fund.

When Social Security was enacted, life expectancy was such that it was calculated that only 1 1/2% of the population would collect it. And a significant benefit was for widows of workers who died early. I would also raise this to 72.

Means testing? No. Seniors have been means tested all their lives, with those earning the most contributing the most. Of course I realize that life’s high earners aren’t necessarily those with the most money as seniors, but that seems close to the mark.