How Much Should Health Insurance Cost?

Why buy health insurance for relatively inexpensive, routine medical expenditures? This is a question Austin Frakt asked at his blog the other day. To be charitable, he missed the obvious answer. If you buy insurance for items you could easily afford to pay for out of pocket, you will almost certainly be throwing money away. Check out the premiums for standard insurance products in the area where you live. I can almost guarantee that first dollar coverage will never make any financial sense.

Basically, there are two ways to insure for medical expenses: third-party insurance and self-insurance. When we pay health insurance premiums, we are purchasing third-party insurance. The alternative is to buy less coverage from an insurance company and put money into an account which you own and control and from which you can pay for medical expenses directly.

How much of your health care dollars should you devote to third-party insurance and how much to self-insurance? That depends on market prices.

You Better Shop Around

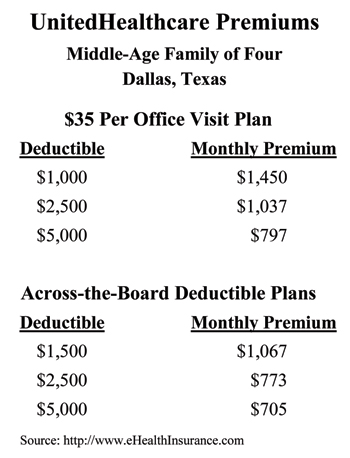

Take a look at the table below. It shows the premiums charged by UnitedHealthcare for a middle-aged family of four in Dallas. Consider the first group of plans, with a $35 copay per office visit. The monthly premium for a family of four with a $1,000 per person deducible ($2,000 per family) is $1,450 — or $17,400 per year.

Now consider the consequences of choosing a higher deductible.

In moving from a $1,000 annual deductible to a $2,500 deductible, the family is exposed to an additional risk of $1,500 per individual ($3,000 per family). In return, they can save almost $5,000 a year in reduced premiums! In moving from a $1,000 to a $5,000 deductible, the family takes on an additional $4,000 of risk per individual (but no more than $8,000 per family). But the premium savings is nearly $8,000.

If you think about it, this table is inexplicable. Why would anyone in his right mind buy the $1,000 deductible plan? Or in the second grouping, why would anyone ever buy a plan with a $1,500 deductible? Gerry Musgrave and I discovered the same phenomena when we studied individual insurance premiums around the country two decades ago. At the time, I decided that as more people began to understand deductibles these oddities would disappear. I was wrong.

If you think about it, this table is inexplicable. Why would anyone in his right mind buy the $1,000 deductible plan? Or in the second grouping, why would anyone ever buy a plan with a $1,500 deductible? Gerry Musgrave and I discovered the same phenomena when we studied individual insurance premiums around the country two decades ago. At the time, I decided that as more people began to understand deductibles these oddities would disappear. I was wrong.

Note: Dallas is a high-cost city and the savings from higher deductibles may not be as large in other areas. Also, the savings from higher deductibles are generally smaller for group insurance.

Now back to Austin for a moment. He cites an NBER paper showing that large insurers get better price discounts than uninsured patients buying care on their own. But that’s only because the typical uninsured patient is ignoring market opportunities to get better deals. As I showed in previous posts (here and here), if you are paying cash and you are willing to travel, you are likely to get care for about half the price that Blue Cross pays.

What about people who have high deductible insurance? When they pay out of pocket they almost always pay whatever rate their insurer has negotiated, no matter who is paying the bill.

Excellent post.

You wonder why the principle here isn’t obvious to more people.

I always believed that one of the greatest incentives for adding coverage to insurance plans is the tax deduction for employer based plans. Insured expenses are deductible while out of pocket expenses generally are not. Most people do not run the numbers and feel they are getting a tax break when they go through the insurance company.

Like the song.

On the $35 co-pay plan, changing from a $5,000 deductible to a $1,000 deductible lowers a family’s financial exposure by $8,000 [($5,000-$1,000) x 2]. I find it hard to believe that the cost for lowering the risk by $8,000 is $7,836 [($1,450-$797) x 12]. This raises an important question: who in their right mind would pay nearly $7,836 to lower their financial exposure by $8,000?

The Affordable Care Act has a built-in bias for low-deductible plans. Part of this is probably because the left-leaning, public health busybodies fear people (especially low-income people) might put off seeking care to save a dollar. But, I think there is also another goal: to create bigger cross-subsidies. Healthy (low-risk) people are better off buying high-deducible plans. Unhealthy (high risk) people tend to want comprehensive health plans with first-dollar coverage. If low-risk people are allowed to buy high-deductible plans (and pay for incidental medical needs out of pocket), the cost of comprehensive health plans will rise over time due to adverse selection (i.e. if only sick people want comprehensive plans, the cost will rise). Public health advocate want to strongly encourage (i.e. force) healthy people to over-pay for comprehensive health plans so unhealthy people can enjoy lower-premiums on plans that feature first-dollar coverage for medical care.

I’ve always thought that the individual mandate would not be so objectionable if it were merely a requirement that people have proof of financial responsibility – such as a high-deductible, limited benefit health plan. Such a plan would be sufficient to ensure that 98 percent of the population would not exceed their maximum benefit in any given year. But what sounds good on paper isn’t what public health advocates want. They would prefer public sector socialized medicine; but they will make due with private sector socialized medicine. Low-deductible health plans (whether through an employer or the government) are an example of socialized medicine.

How is it different to pay for costly, community-rated premiums for a health plan that pays for medical care with an insurance card versus paying taxes and paying for medical care with a Medicare For All card?

Very good post. Very sensible.

Great post, and I am a high-deductible fan. There is a caveat, however, and it is prescription drugs. Typically prescriptions are covered by a copay. But under a high-deductible plan, the patient pays the full price until the deductible is reached.

For example, a drug that costs $50/month under a copay may cost $2100/month under the high-deductible. Admittedly most scrips are not nearly this expensive, but you won’t know unless you ask.

In other words, do the research.

Understanding the vagaries of medical insurance pricing is always going to be difficult, though there are some actuarial justifications for particular company differentials, but that won’t stop them from looking silly. The pure actuarial credit to increase a deductible should never be equal to (or greater!) than the difference in the deductibles, but behavior and individual company experience also come into play, producing the kinds of differentials we see. In this case, there is the additional complicating factor of the copay benefits. While there is a huge caveat due to the fact that we don’t have the full comparison of the plans being described, a more interesting question is why would someone buy the copay policy with the $2500 deductible versus the non-copay plan with the $2500 deductible? The difference in premiums is $3,168 annually that you could use to pay for those doctor visit costs (and without a copay), which is a lot of visit costs, but further to the point, guess what, those costs would count towards the $2500 deductible, and before you spent it, you might actually be into coinsurance benefit! (This depends on whether the family deductible has an embedded individual limit, which I presume it does.) Again, there could be other significant differences between these plans that would come into play, so this may be simplistic, but still interesting. (By the way, I see the same kind of bad personal economic decisions made even within group plans where there are options provided, and there are different contribution requirements depending on the choice. The same kind of behavior is shown.) It is likely that it is the “shock” value of having to come up with the annual deductible all at once (or the fear of it) that chases people into the arms of the lower deductible plans, even though over the course of a year, they would be better off. Financing programs, anyone? Oh, and my company specializes in designing benefit plans that eliminate this problem by utilizing what we call “defined monthly budget” programs, such as monthly deductibles instead of an annual deductible. Works like a charm.

Very sensible.

The reason why I am not in a high-deductible plan is actually a confluence of four factors: first, my employer pays most of my health insurance premiums, so there is a negligible gain to me in immediate cash flow by changing from one to the other. In theory, if my employer spends less on my health insurance they would have more to spend on me, but it would take years for that money to “trickle sideways” on the balance sheet and I have no practical guarantee that it would do so anyway. Second, there are 7 dependents on my policy, most of whom are young children that visit the doctor frequently, so the likelihood of blowing through the family deductible is very high, in fact a near certainty; third, the difference in premium is not that large once you factor in the deductible spend; and fourth, I am aware from my line of work that direct-pay for medical care is only a few steps short of hell. When you wrap it all up, I’m not willing to subject myself to the annoyance, headaches, and ton of work it would cost me to negotiate direct payment of health care in order to save myself $100 or $200 at the end of the year; it’s just not worth it.

Good questions John Goodman. It is frustrating that people have such difficulty in making sound decisions regarding deductible options. But I am still perplexed by an even more basic question of logic illustrated here. Why would anyone opt for anything offered in the first table (with the $35 copay) when the options on the second table are available?

The easy (but not in depth answer) is that people think it is a “good deal” to only pay $35 when they go see a doctor, and you could say they are basically too lazy to manage their own healthcare costs.

As a long fanged health insurance veteran I can attest without any doubt that the doctor office “copay” concept is definitely NOT a good deal, and in fact is the most atrocious waste of healthcare premium dollars I have seen. Not only is it a waste of premium but it is highly effective in masking the true costs of healthcare. As far as the patient is concerned the cost of a $1,100 MRI is the $35 copay, and there is little interest in the real cost of the health encounter.

Originally copays were basically a marketing concept to entice physicians to join networks (because they guaranteed payment to the docs freeing them from chasing down delinquent office visit charges). That seemed to be a benign enough notion at the time, but I don’t think many foresaw that it would become one of the entitlement crutches that make meaningful healthcare reform difficult to accomplish.

OK, Dr. Goodman, I get it: higher deductibles means lower premiums. But how do you expect an average American family with median income of $50,000 to afford a $5,000 annual deductible, if their company does not fund their HSA? The problem with HSA’s, as I’ve said before, is the middle word. Americans by and large are not into saving.

John ,

Health care reform seems more and more every day to a model from right wing social thinkers. Heritage Foundation and Newt were trying to slow down Hilary and Bill Clinton with Health Care Reform days of the 90s and then come up with current model.

As the current administration was thinking of reform it is reported that Mitt suggested they should look at Mass . Plan. So, they did and they came up with current reform. Mandate seem the only source of critique now. Some 80%+ in Mass plan seems to like their system now. Mandate for car insurance does not seem to raise concerns in the population.

If you would like to eliminate or weaken health insurance in USA, per the Canada model , might be a progress model to consider. We could then copy the Vermont or the UK model. I am sure you would like to bring a universal govt. model.

Stan

Part of the answer is in two pieces:

1. Agents generally get paid on a % of premiums. They don’t get commissions on HSAs or direct consumer savings.

2. If higher deductible non-HSA non-FSA plans are purcahsed through an employer the premiums are pre-tax with employer subsidies. The cost-sharing deductible must be paid after tax. Thus you need to compare the deductibel with the consumer after tax costs versus the consumer premium contribution not the total premium.

James:

You ask an excellent question.

How can a median income family with $50,000 afford a $5,000 deductible.

Answer: it is very difficult.

One way to accumulate $5,000 is through savings. However, if you’re only getting one percent on your money, it is poing to take a long time.

However, if you get a 300% return, it takes about one year, paying $200 a month, and it is a $5,000 paid-up policy.

Don Levit

Stan Ingman, with all due respect your comments are completely incorrect. “right wing” social thinking is the polar opposite of the structure of the system we have now. There is no premium (incentive) for individual management present (in any meaningful way) in the healthcare models that dominate today.

And mandating auto insurance is not even analogous to mandating health insurance for many reasons. Among them is the fact that no one is being forced to own or drive a car (thereby requiring liability insurance). Put another way, no one, by virtue of their U.S. citizenship is required by the federal government to purchase liability insurance. This fact alone disqualifies any comparison of same to the health insurance mandate.

Love the video!

Great Post! I have been preaching this for a long time. As for as trying to negotiate direct payment of health care that Paul mentioned there are low cost programs that do this for you and they include Rx and Dental and other programs as well. If anyone would like more information they can contact me at 865-357-3379 and I will be glad to help they.

A copay plan is similar to taking a business trip – you get a better flight, rent car, hotel, and eat better – why? Because it’s company money!!!

A high deductible health plan is like a vacation – you’ll take an early flight to save $100/person, don’t need a rent car since there is a shuttle to the hotel, don’t neet a great hotel because you are at the park all day, you’ll eat a nice meal when you want to, but eat a pizza or the hotel buffet – it’s a more efficient use of money – because it MY MONEY!!!

Bottom line is people make better decisions with their own money than someone elses (citizens vs gov’t). The healthy are better off, the high users are better off due to the tax deductions of the out of pocket costs. It’s the moderate users that have a tough decision – copay or HDHP H S A?

Patrick, your analogy is right on. With regard to “moderate users”, there is still not a logical reason to buy insurance with copays simply because the premiums charged for such coverage take into account the use of the copay. Put another way, to use a copay and have the insurance pay the difference you are paying an extra premium due to the fact that insurance companies charge roughly twice what the benefit is worth to cover the expense of paying a small claim. Therefore moderate users would be better off saving the premium expense and paying for the doctor visits themselves.

Of course one can take individual cases anecdotally and show how the copay might be better in certain instances (say if a patient knew he was going to have many very costly office visits over an extended period of time). Even then the financial decision is not clear because with a higher deductible program the calendar year deductible will likely be met and the insurance coverage would start to pay. People sometimes forget that the copay charges paid by the patient do not apply towards satisfying the deductible, and these copay charges can mount up with frequent office visits. Note the differences in the premium for plans with and without the copays (above).

John, it would be useful to know how many people actually buy the dominated low deductible plan. After all, it costs almost nothing to post a premium on ehealthinsurance. Maybe some fool will buy it and, if not, it makes the higher deductible plans look much more reasonable. I am afraid there actually may be some purchasers, but the same thing shows up in car insurance and homeowners insurance. Still, I suspect we have lots of evidence that many people are not that foolish, even if not all.

This is a great discussion, if one is trying to decide on a yearly basis what policy to buy.

What may be more advantageous, particularly in the long run, is to build up benefits much faster than an HSA, and still provide coverage from dollar one. The objective is to not make claims, particularly smaller claims, in order to build benefits on this primary policy.

In fact, we envision if one is deciding to make a claim, to send him what his increased premium will be the following month, due to the lower primary coverage and lower deductible.

Don Levit

This is a great discussion, but it keys off current behavior of the insurance system, which is driven by its history of its casualty ancestors; the sudden, unpredictable costs of acute care is what they intend to protect people against. That was fine in the Fifties. Today, more than 70% of claims are for some phase of a chronic disease, or for more than one chronic disease. The average for people over 65 is 5. With this demographic albatros, indemnity insurance does not make any kind of sense, no matter how one plays with the numbers.

If we all admitted that the “main event” is chronic disease care, with occasional acute episodes, we would do something like the following:

1. A basic major medical

2. A primary care membership that assures access to a physician and tracking of chronic diseases. Enrollee would pay a sliding scale fee, based on age.

3. A “Rider” for each chronic disease that is a two-way mutual contract; the patient pays a monthly fee, and agrees to follow a course of health management. If he does and does well, the fee is reduced; if he does not or does not improve, the fee is increased. The “mutual” part applies to everyone in this class; if they all do well, they get a dividend at the end of the year, or lower premiums the next. We should have our top 20 chronic diseases handled this way.

Also, high deductibles, where the enrollee is on his own relative to office charges is subject to varying state laws; in some, a retail charge that is lower than the negotiated insurance rate triggers a clause in that contract that the health plan can consider that a new “reasonable and customary” fee, subject to their negotiated discount from charges.

For doing all this right, we not only need new insurance and payment methods, but new settings for care that start off with the idea of cash, no insurance. Will work for a lot of people. Then, one for women and children, then one for adult males.

In other words, to mess around with payment without redesigning delivery for specific populations is just crazy-making.

Not only that, but current policies wrap around a stage of medical science that is on its way out. New policies would support a new form of diagnosis and treatment–one based on genetics–and aim for cure, not just a reduction in symptoms. Read the following book, all you policy guys–Topol, Eric, M.D., The Creative Destruction of Medicine: How the Digital Revolution Will Create Better Healthcare, Basic Books, New York, 2012.

Hi to all..

Wanda J. Jones, President

New Century Healthcare Institute

“Part of this is probably because the left-leaning, public health busybodies fear people (especially low-income people) might put off seeking care to save a dollar”

Devon, regardless which way you lean, there’s ample objective data that people DO put off seeking care to save a dollar.

Why not do as Aetna has done with HDHP/HSAs: get aggressive about the preventive screenings & treatment that can be covered by the plan EXEMPT from the deductible? Sensible & effective for the plan AND the plan participant.

This from a HDHP/HSA advocate. One of the real bungles by supporters has been to “politicize” what is unarguably a sensible plan design for people of all ideological persuasions.

When you make HealthInsSort your source for health insurance comparison, you put all the latest data at your fingertips, whether you are using the internet or the telephone.Either way, useful health insurance rates and all the details of the plan you have in mind are available instantly.

A couple points your posters missed:

1. Co-pay plans are waaaaay more popular than straight deductible plans (contrary to one commenter’s suspicion). They are more popular with young people and high utilizers. Cash flow management is a key reason for the young, but also the rates are very low in an underwritten environment (run the rates in Dallas for a 25 year old single male).

2. Another reason low-deductible plans are expensive/don’t make sense is that we have to layer the claims with tax, commission and administrative expenses. That will be even worse with the PPACA because of the new excise taxes & exchange fees and the generous first dollar benefits.

3. The new 100% preventive benefits have caused an EXPLOSION in utilization of OP and physician services, especially in high-deductible plans, so the relative price difference will be shrinking in the near future.

Keep up the good work,

An Industry Insider

Fantastic items from you, man. I have take note your stuff previous to and you are simply extremely excellent. I really like what you’ve acquired right here, certainly like what you’re stating and the way during which you are saying it. You’re making it enjoyable and you continue to take care of to stay it smart. I cant wait to learn far more from you. This is actually a terrific web site.