Hiring in Health Care Finally Slows Down

Fast-paced hiring in health care, which I previously discussed with respect to the jobs report for August, seems to have tempered in September. The case I’ve been making over the last few months is that healthcare providers have been adding workers faster than the rest of the economy. In September, that turned.

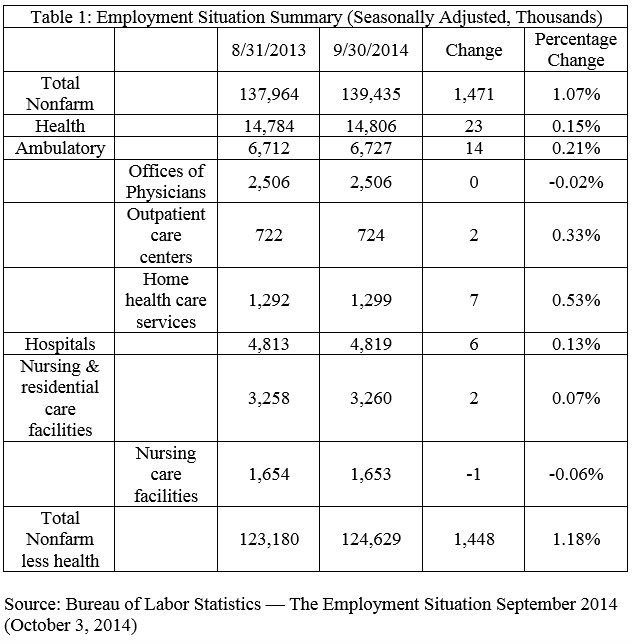

As shown in Table 1, nonfarm payrolls increased by 1.07 percent from August, seasonally adjusted. However, when health care is separated from the rest of the workforce, the headcount increased by only 0.15 percent, versus 1.18 percent for the non-healthcare workforce.

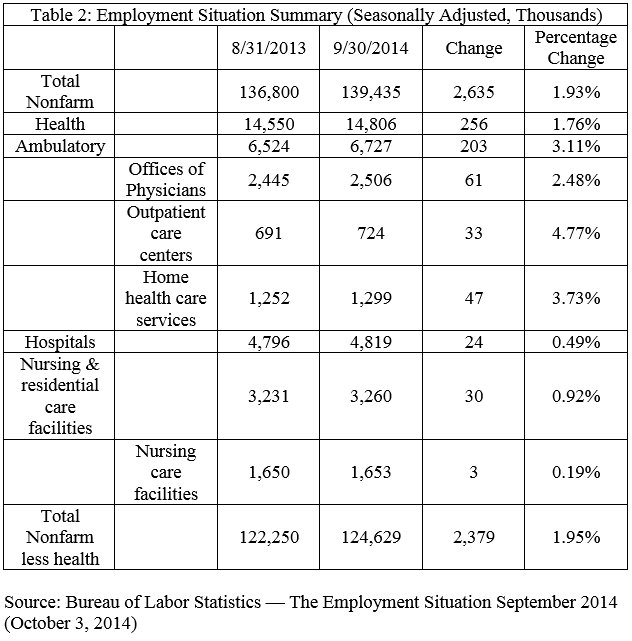

Table 2 shows the longer term. Over the last twelve months, the rate of hiring in health care and other sectors has been about the same (1.76 percent versus 1.95 percent). However, as previously discussed in this blog, the healthcare workforce is undergoing significant transformation. Hospitals have added very few workers since September 2013, whereas ambulatory facilities have been hiring robustly

Probably because healthcare M & A increased in hospitals and health systems in 2013 according to Kaufman Hall. 2013s mergers were up over 50% compared to 2010 so that’s a lot of duplicative employees to downsize. 98 hospital and health systems merged including a couple of bigees in Tenet and HMA out of Florida. How many of those administrative and management folks are now out of work? Anecdotally, the govt is making it harder for the little guy to compete in home health, DME and even physician practices so there’s probably not a lot of hiring from mom and pop healthcare shops. No wonder hiring has decreased.

Thank you. From what I read, the M&A market in health facilities is still very hot.

Additionally, Medicares Competitive Bidding program has shut down hundreds if not thousands of smaller local DME companies and pharmacies as well. The media never talks about the little guys who are getting crushed in the healthcare arena because they have no political voice like hospitals or doctors do, but many of them are the small businesses that keep the countries economy moving – albeit at a glacial pace.

Thank you again. I have not seen data on what the DME competitive bidding has done to some smaller companies but it makes sense that a shaking out would be a consequence.

However, I have seen no evidence of harm to patients due to DME competitive bidding, and it has clearly saved money for Medicare.

We should never prop up over payments to protect suppliers. Competition does not mean all competitors thrive: Some shrink.

John, Don’t want to beat a dead horse but restricting freedom of choice of your provider will ultimately lead to deficient care as the providers own enough market share it has an inverse effect on Competition. Case in point is diabetic supplies. There were over 200 mail order Diabeteoc suppliers 3 years ago and now there are 20. With reduction in reimbursement and guarantees increase in cranky customers, Quality of patient care will assuredly go down. These patients ER visits due to improper blood sugar spikes will not be tracked back to reduction of BS testing in any academic studies due to restricted access to DME suppliers but it will most likely occur. Look at how the VA hospitals which have a captive audience of patients have treated its patients and this will be the same result with Competitive Bidding. NCPA should do a real study on reduction in DME fees, reduction in number of participating suppliers and patient satisfaction. I’d like to see your unbiased results.

Thank you. If you have donors for such a study, please give me a call.