Employer-Based Benefits: Health Spending Up 3.9 Percent in 2013

The Health Care Cost Institute, a collaboration of four major insurers, has published its 2013 Health Care Cost and Utilization Report and companion Out of Pocket Spending Trends 2013, which discusses cost trends for people with employer-sponsored insurance (ESI):

In 2013, health care spending for the national ESI population grew 3.9%. This growth rate was similar to the rates observed in 2011 (4.0%) and 2012 (3.7%). Spending growth for 2013 was driven mainly by rising prices rather than by utilization, as use of many services declined.

That is mixed news. Prices for outpatient services increased 5.8 percent and by 21.1 percent for brand-name drugs.

Spending per capita was $4,864. However, the report also breaks down spending by age, gender, and geography. What I found interesting was that spending for adults aged 19 to 25 averaged $2,574 per person, but $9,232 for adults aged 55 to 64. The older folks spending was 3.6 times greater than the younger ones. That is a lot smaller range than actuaries tell us.

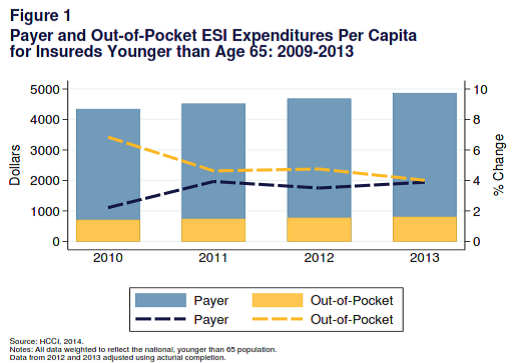

What is also concerning is that the rate of growth in the share of health spending controlled by patients directly (often called “out-of-pocket” costs) is slowing relative to the share controlled by insurers. Figure 1 shows that the rate of growth of out-of-pocket spending has been dropping as the rate of growth of insurers’ spending has increased. They are now about equal at four percent.

What would also be very interesting to know is the proportion of out-of-pocket spending is distributed within one age group. For example, are the sickest 19 to 25-year olds paying many thousands out of pocket, while most pay none? If so, that would indicate that employer-based benefits have features similar to Obamacare that make insurers design plans to attract the healthy and not the sick.

The rate of growth in the share of health spending controlled by patients directly is slowing relative to the share paid by insurers

How does this fact attract the healthy and not the sick?

As people pay less out of pocket would not that attract the sick more than the healthy?

Don Levit

Managing Partner

National Prosperity Life and Health

At the margin, I think I would agree with you. However, we are talking here about employer-based benefits, which are designed to attract all employees. (On the other hand, you would want to design your benefits to attract healthy and not sick employees, right?)

The benefits should be neutral attracting neither the healthy or the sick for no one is immune to being in either group

What can be done to keep employer costs down is to increase employer reserves dramatically for self funded plans

This is accomplished as long as 20 percent of the people have 80 percent of the claim dollars

It is a mathematical and actuarial certainty

Don Levit