Administrative Costs for Disability Plans: Do-It-Yourself vs Specialization

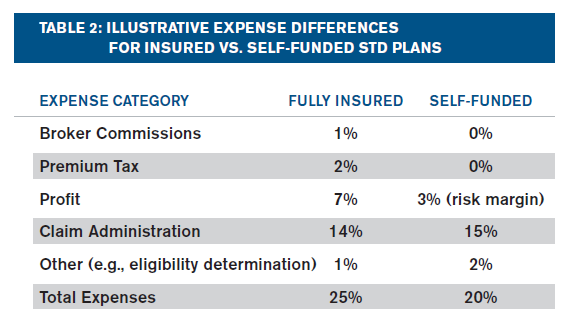

The table provides some general estimates on the costs and benefits of do-it-yourself health coverage. It was developed by Milliman, for employers considering self-funding a short-term disability plan of 10,000 lives. It is interesting because it sheds some light on what Milliman believes specialized insurers do well.

Companies that specialize in insurance have lower claims administration and eligibility determination expenses. The accompanying report emphasizes that the advantage from self-funding depends heavily on the cost of developing expertise in claims management. Self-insured employers must be adept at medical bill reviews, reviews of medical treatment plans, rehabilitation programs, workplace modification, claims management, and fraud prevention. Non-specialists will have higher claims costs, and the cost of developing this expertise, and the infrastructure needed to support it, “could be prohibitive” for many employers.

This warning would undoubtedly apply to government entities that seek to save money replacing specialist private insurers with government run “self-insurance” program. But for the moment, let’s assume perfect government expertise in claims management and eligibility determination. A “self-insuring” government would not pay the 4 percent that private insurers charge for assuming disability. Unlike self-insured employers, it gets revenues from the 2 percent premium tax. If government self-insures, it loses that revenue stream.

Lift the ridiculous assumption that government self-insurance is as efficient at claims administration and eligibility determination, and this set of estimated costs suggests that taxpayers could save when government decides not to self-insure.

Why not shift to companies that specialize, do it yourself seems to have too many costs before any benefits can be seen.

“Non-specialists will have higher claims costs, and the cost of developing this expertise, and the infrastructure needed to support it, “could be prohibitive” for many employers.”

Things could become even more problematic for many employers choosing this option. Especially facing more implicit costs.

Why take the time to develop this expertise when you could just hire specialized companies. Seems to not make a great deal of sense.

“Lift the ridiculous assumption that government self-insurance is as efficient at claims administration and eligibility determination”

The government is less efficient at most things that can be substituted from the private sector.

The less that the government assumes they are just as efficient as a private sector company, the better off the country is.

In our Health Matching Insurarance model Cap Rock a well respected TPA in TX is handling all claims administration

The per member per month charge is paid by the self insuring employer not Natipnal Prosperity life and Health

With HMI NLPH pays claims from the first dollar

Our patented paid up benefits rider accumulates benefits faster than average claims so that employer premiums reduce over time

West cost more in the beginning of the plan but with first dollar coverage we should be competitive at year end

Working with. Milliman for three years we will be able to quote expected premiums over three to five years which could lower premiums sixty to eighty percent

Brokers working in the self insured market with employers who have 200 or more employees can contact me at donaldlevit@aol. com

Don Levit

Principal of NLPH

Very interesting topic , appreciate it for posting . The friendship that can cease has never been real. by Saint Jerome. ekccaaadbbcf