Slow Growth, Downward Revisions in Health Jobs Continue

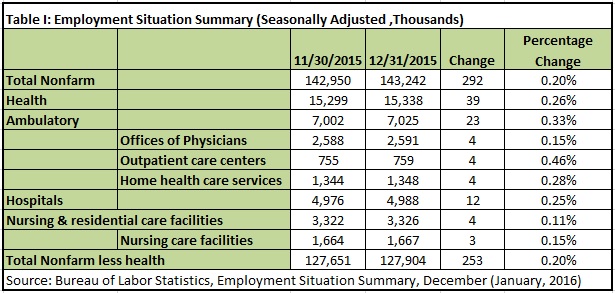

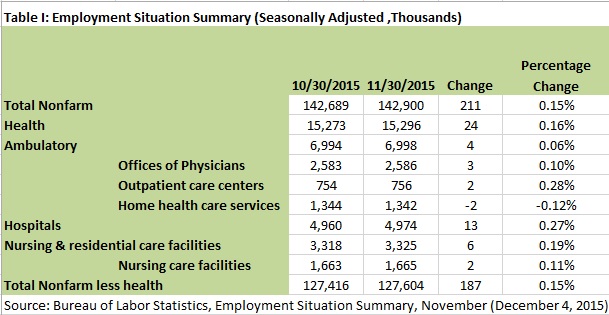

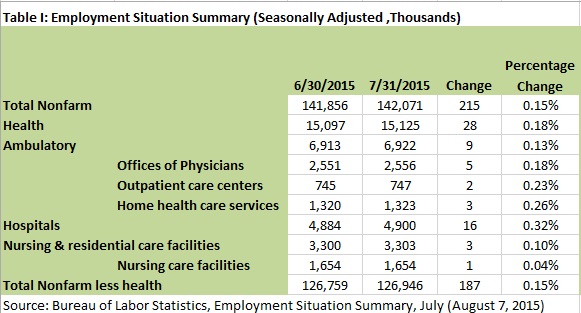

For the second month in a row, the Employment Situation Summary showed a slowing down in the growth of jobs in health services versus non-health jobs, relative to recent history. Further, revisions to data in this morning’s very strong jobs report indicate high job growth reported in health services for December and January were not correct.

For the second month in a row, the Employment Situation Summary showed a slowing down in the growth of jobs in health services versus non-health jobs, relative to recent history. Further, revisions to data in this morning’s very strong jobs report indicate high job growth reported in health services for December and January were not correct.

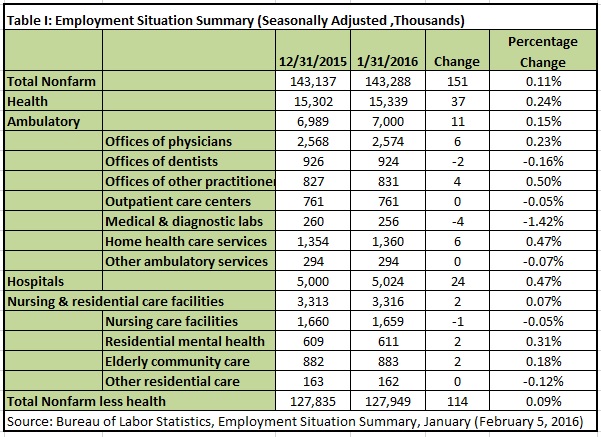

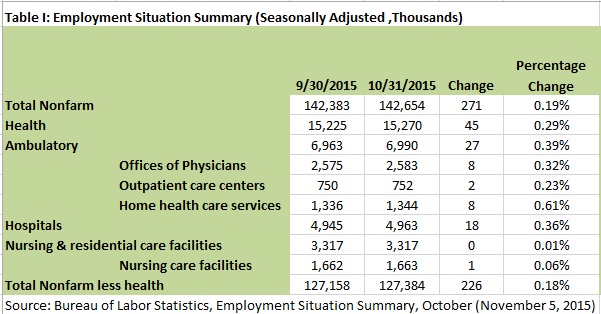

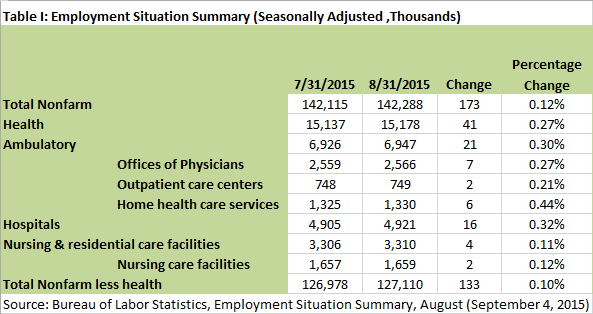

Health jobs increased only 0.17 percent in this morning’s jobs report, versus 0.16 percent for non-health jobs. With 27,000 jobs added, health services accounted for 11 percent of new nonfarm civilian jobs.

This continues a welcome development. The previous disproportionately high share of job growth in health services was a deliberate outcome of Obamacare. If this trend persists, it will become increasingly hard to carry out reforms that will improve productivity in the delivery of care.

Ambulatory sites added jobs at a much faster rate than hospitals (0.25 percent versus 0.12 percent). This was concentrated in physicians’ offices and home health. This is a good sign because these are low-cost locations of care.

See Table I below the fold: